Empowering Options Traders & Stock Investors

Explore in-depth research, strategic insights, and timely stock options strategy recommendations from our team of expert analysts.

Latest Stock Options Analysis & Trading Strategy

CMG Stock Options Profit Update: +103% LEAPS Gain in Just 2 Months

Procter & Gamble (PG) LEAPS Call Options Analysis: High-Delta Rebound Strategy After a Major De-Rating

T-Mobile US (TMUS) LEAPS Options Analysis: High-Delta Mean-Reversion Strategy After a Deep Pullback

Nutanix (NTNX) LEAPS Options Analysis – Oversold Opportunity With High-Delta Reversal Potential

The Trade Desk (TTD) Stock Options Analysis — Positioning for a Major Long-Term Rebound Using LEAPS

Stock Screener

Find your next winning trade in seconds.

Quickly filter through the market to find stocks that match your strategy. Screen by fundamentals, technical indicators, analyst ratings, insider activity, and more — all designed to help you spot high-potential opportunities faster.

VIXTradingHub

Options Chain

Break down every strike, expiration, and contract with ease. Our Options Chain tool helps you track open interest, volume, Greeks, and premium pricing — giving you the clarity to plan trades with precision.

VIXTradingHub

Insider & Political Trades

See what the insiders and lawmakers are buying and selling. Track corporate executives, U.S. Senators, and House Representatives as they disclose their trades — giving you a unique edge into the moves of influential market players.

Our Mission & Vision

Our mission is to apply a disciplined LEAPS strategy designed for relaxed medium- to long-term trading — not day trading. We focus on fundamentally strong stocks, enter long-dated calls with delta around 0.5 and strong vega, and patiently hold as volatility builds ahead of earnings or catalyst events. The way we do it, even if a stock only rises 20%, we can still capture 100% gains by profiting from both delta movement and vega expansion. Our vision is simple: buy vega when it’s cheap, sell to close before catalysts when it’s expensive, and keep risk managed every step of the way.

Track Your Portfolio

Monitor your investments, analyze performance, and make informed decisions to optimize your asset portfolio.

Recent Market Analysis

Weekly Market Analysis: “Market Pulse This Week”

Fresh off the latest trading sessions, investors are rightfully asking—what’s moving the dial in the markets this week? In this […]

Weekly Market Analysis: Key US Stock Market Trends and Outlook for November 2025

Over the past week, the US stock market trends showed a sharp reversal in sentiment—initial weakness gave way to a […]

US Stock Market Outlook This Week: Can the November Rally Continue? (Week of November 1, 2025)

As we enter November, investors are watching closely to see whether the US stock market outlook this week can sustain […]

Why VIXtradingHub?

“We help traders of all levels access powerful tools, insights, and strategies—without the complexity. Our platform simplifies financial data, so you can focus on what matters: smart decisions and strong results.”

Get the NEWEST IPOs

Circle (CRCL) IPO: The Next Fintech Titan Backed by Cathie Wood and BlackRock 3x Potential

🚀 Why Circle (CRCL) Checks the IPO Boxes 1. Revenue Growth & Profitability Trajectory 2. Gross Margin & Business Model […]

IPOs: 10 Best Criteria to Pick Profitable Upcoming & Recent Listings

Top 10 Criteria to Pick Profitable IPOs 1. Strong Revenue Growth (YoY or QoQ) 2. High Gross Margins 3. Clear […]

Learn It All At Our Stock Options Education Center

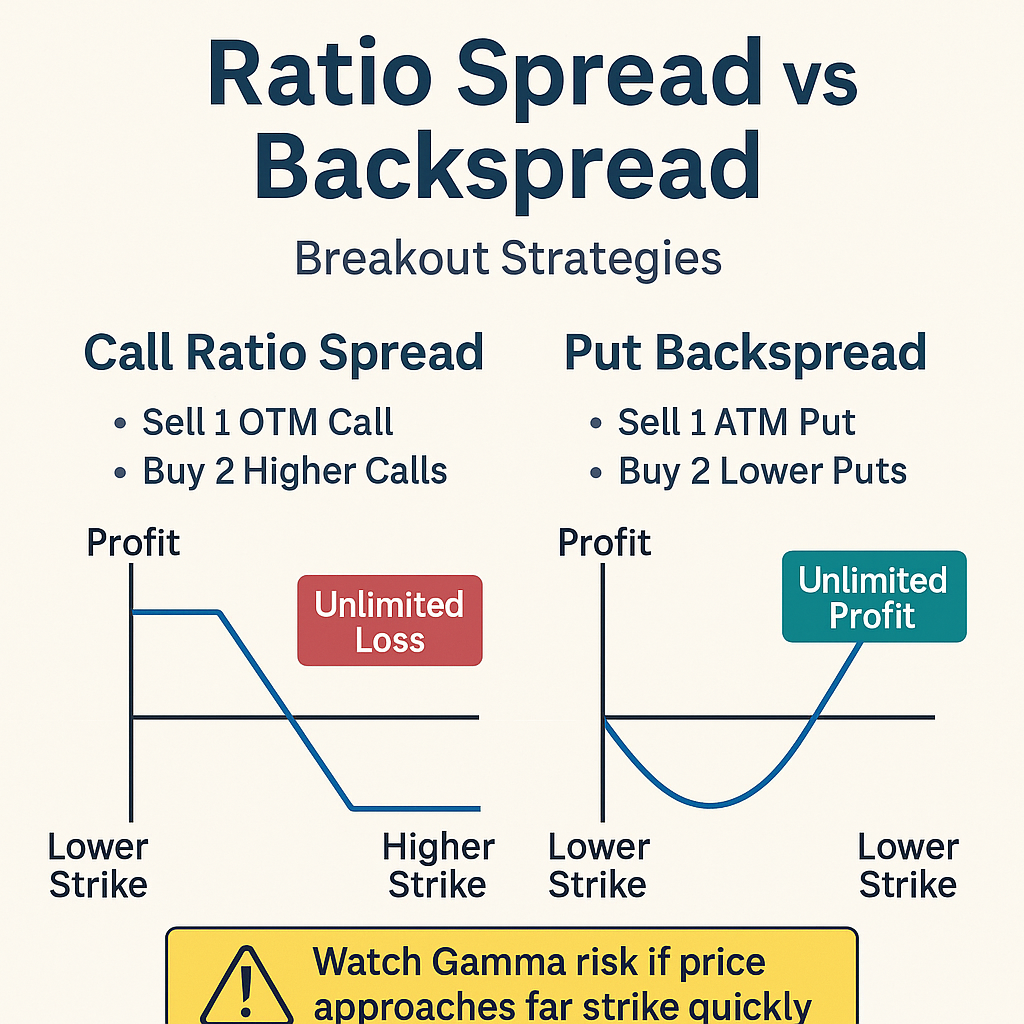

Lesson 15: Ratio Spreads & Backspreads – Strategic Tail-Risk Plays for Explosive Volatility Breakouts

🎓 Lesson 15: Ratio Spreads & Backspreads – Tail-Risk Strategies for Volatility Breakouts 📌 Overview Ratio spreads and backspreads are […]

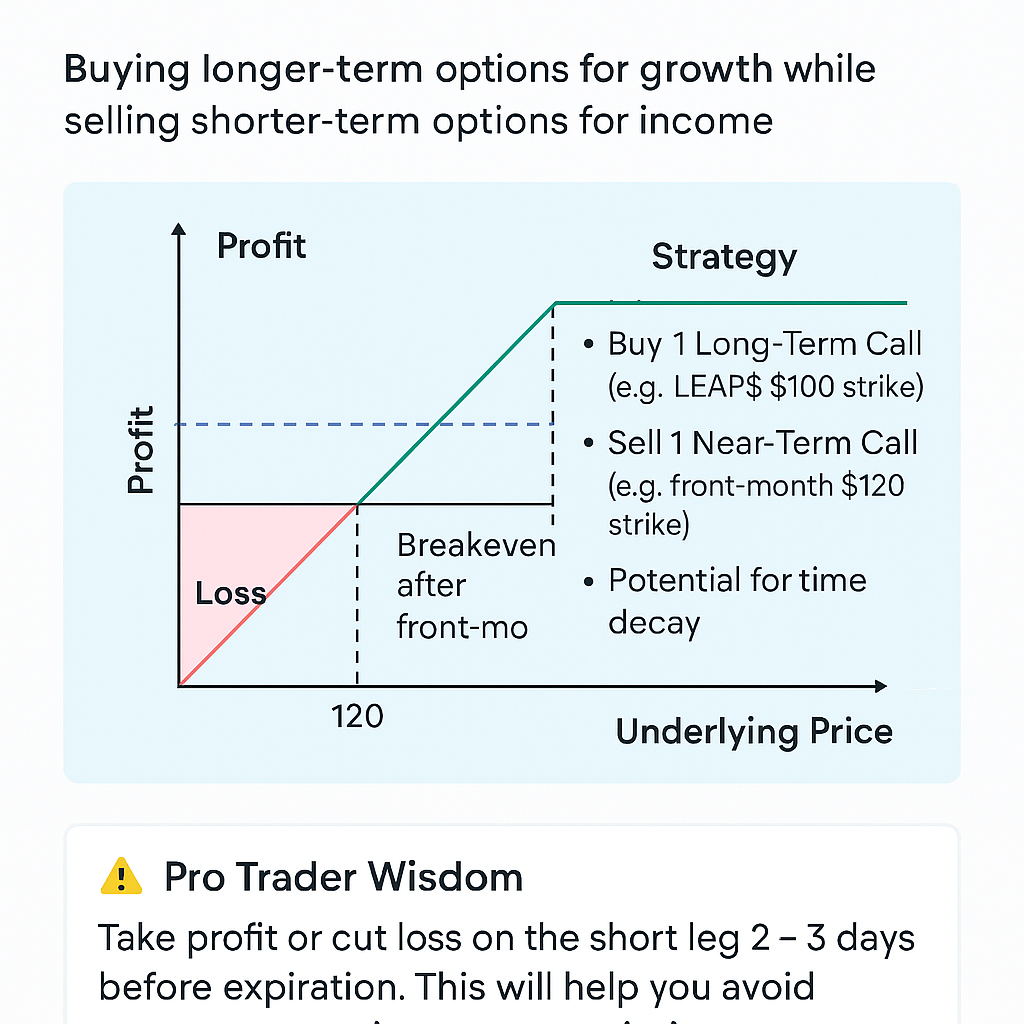

Lesson 14: Diagonal Spreads – Unlocking a Winning Strategic Time-Based Edge with Directional Power

🎓 Lesson 14: Diagonal Spreads – Time-Based Edge with Directional Power 📌 Overview A Diagonal Spread is a hybrid options […]

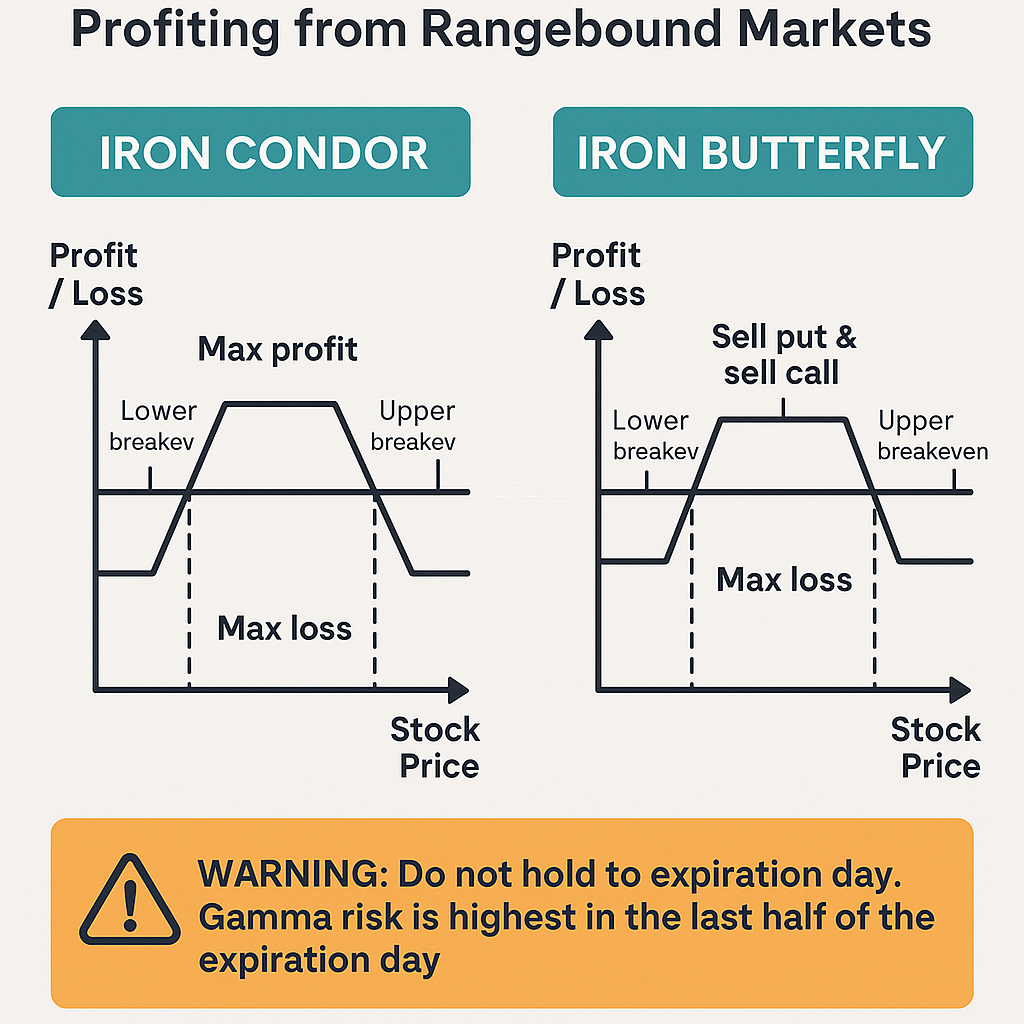

Lesson 13: Iron Condor & Iron Butterfly – Powerful Profiting from Rangebound Markets with Defined Risk

🎓 Lesson 13: Iron Condor & Iron Butterfly – Profiting from Rangebound Markets with Defined Risk 📌 Overview When you […]

Join the Early Access List

“Get exclusive updates and launch bonuses.”