Ticker: PYPL

Company: PayPal Holdings, Inc.

Strategy Focus: Deep ITM LEAPS Call (Stock-Replacement, Mean Reversion)

Executive Summary

PayPal Holdings (PYPL) is trading near multi-year lows after a steep sell-off driven by sentiment, narrative fatigue, and growth multiple compression — not financial distress. Despite aggressive price damage, PYPL continues to generate billions in free cash flow, maintains healthy margins, and trades at historically depressed valuation multiples.

This analysis synthesizes:

- Multi-timeframe technicals (3-month, 1-year, 5-year)

- Fundamental financial strength

- News and sentiment capitulation

- Analyst price-target resets

- Insider, Senate, and House trading context

- Options flow and open-interest structure

- A deep ITM LEAPS call strategy designed for patience, not speculation

The conclusion: PYPL is not broken — it is mispriced, and the optimal way to express that view is through a delta-heavy, low-decay LEAPS position.

Technical Analysis: Multi-Timeframe Perspective

Short-Term (3-Month Chart)

- Sharp capitulation drop followed by stabilization

- RSI reset back toward neutral (selling pressure easing)

- Bullish MACD crossover on lower timeframe

📌 Interpretation: Tactical bounce potential, not a confirmed trend reversal.

Intermediate-Term (1-Year Chart)

- Fresh 1-year low after prolonged downtrend

- RSI deeply oversold (sub-30)

- MACD still negative, but downside momentum decelerating

📌 Interpretation: Early base formation phase.

Long-Term (5-Year Chart)

- PYPL trading near 5-year lows

- Weekly RSI at extreme oversold levels

- Selling momentum flattening, not accelerating

📌 Interpretation: Late-stage drawdown with improving asymmetry.

Fundamental Analysis: Cash Flow Over Narrative

PYPL’s fundamentals contradict the “broken company” narrative.

Key Financial Highlights

- Free Cash Flow (TTM): ~$5.6B

- Operating Cash Flow (TTM): ~$6.4B

- Net Margin: ~16%

- ROE: ~26%

- ROIC: ~17%

- Debt-to-Equity: ~0.6

- P/E: ~7.6

- EV/EBITDA: ~5.3

- P/FCF: ~6.9

📌 Interpretation: The business is profitable, liquid, and undervalued — this is multiple compression, not operational collapse.

News & Sentiment: Capitulation Phase

Recent headlines include:

- “PayPal Is Running Out of Time” (Bloomberg)

- Securities-law “investigation alerts”

- “Once unstoppable” retrospective narratives

- Contrarian “seems broken but strong buy” takes

📌 Interpretation: Uniform pessimism with no new fundamental damage — a hallmark of sentiment exhaustion.

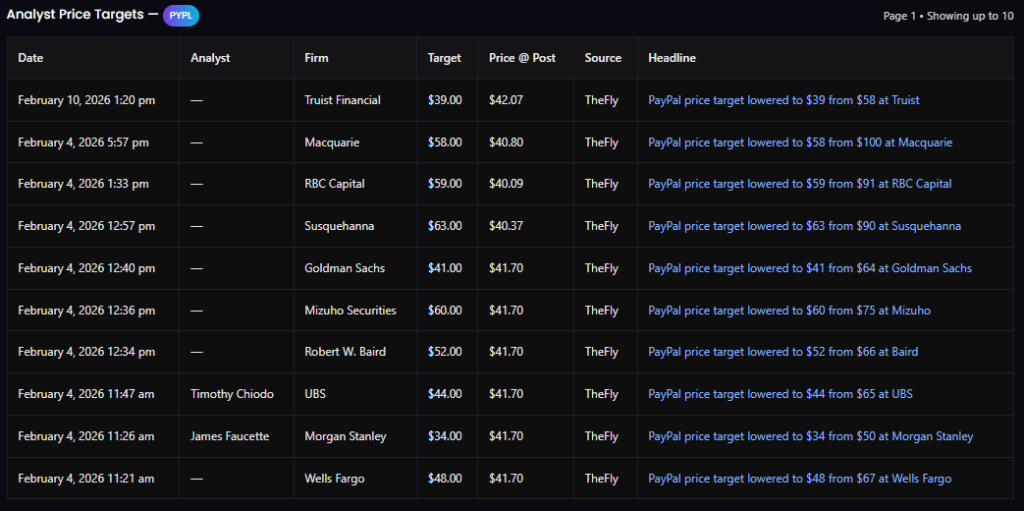

Analyst Price Targets: Late-Cycle Repricing

Multiple firms slashed targets after PYPL’s drawdown:

- Targets cluster between $34–$63

- Majority remain above spot price

- High dispersion signals uncertainty, not consensus collapse

📌 Interpretation: Analysts are repricing growth expectations, not forecasting insolvency.

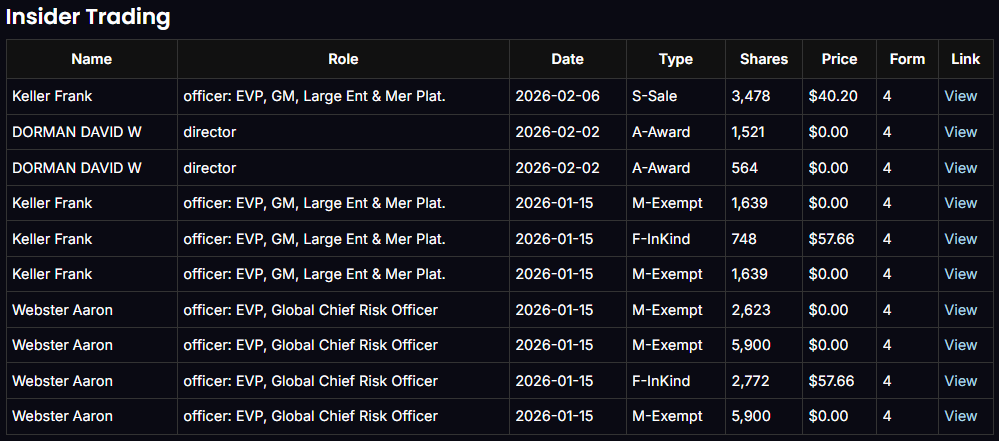

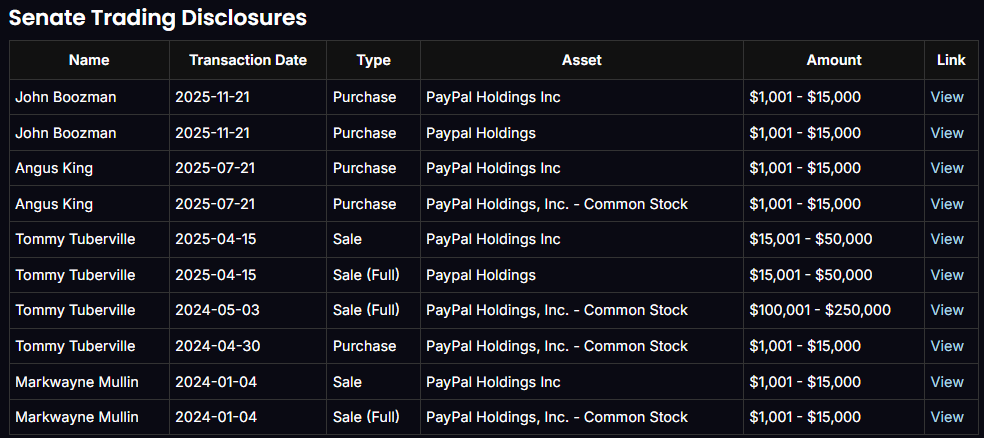

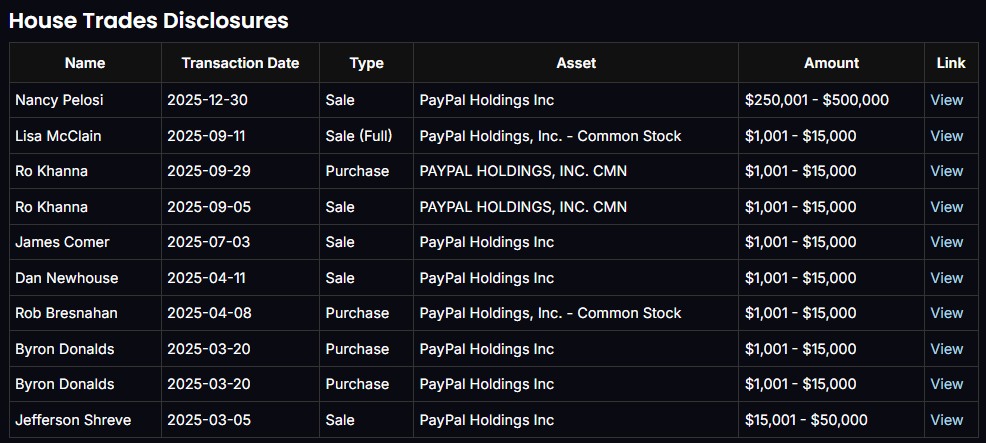

Insider, Senate & House Trading: Neutral, Not Bearish

- No meaningful open-market insider buying

- No panic selling by executives

- Congressional trades are mixed and low-signal

📌 Interpretation: Insiders are not fleeing, which removes a key downside confirmation.

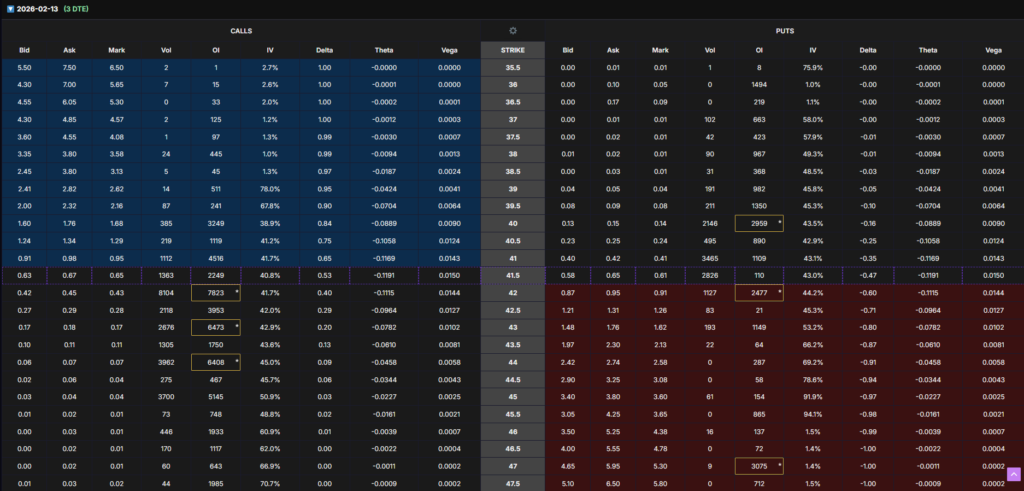

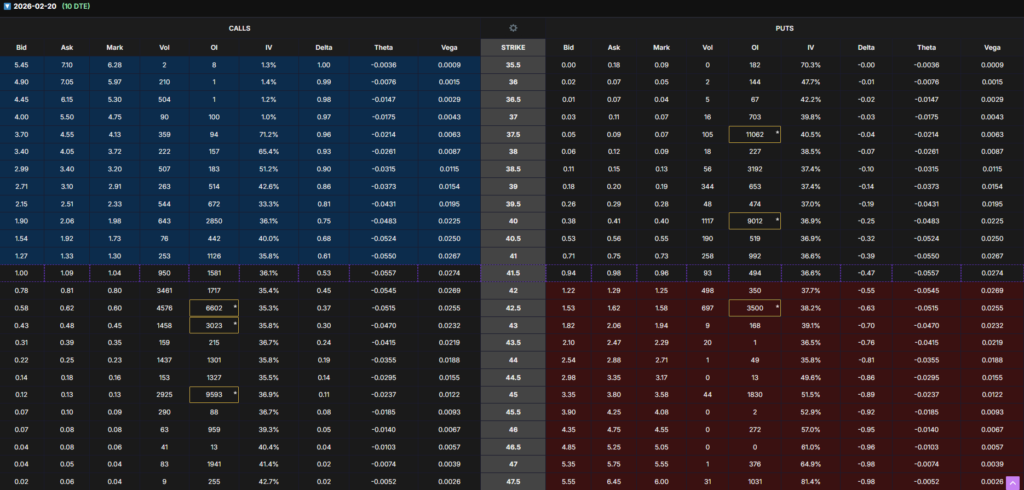

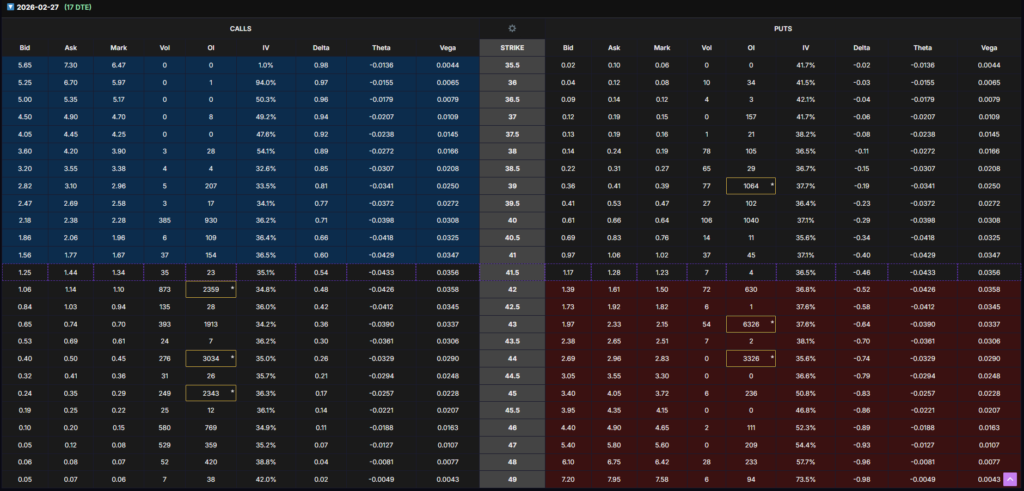

Options Flow Analysis: Call-Side Structure

Short-dated options show:

- Heavy call OI clustered just above spot

- Clear dealer walls in the low-to-mid $40s

- No speculative far-OTM call chasing

📌 Interpretation: Market is positioning for stabilization and controlled upside, not a breakout.

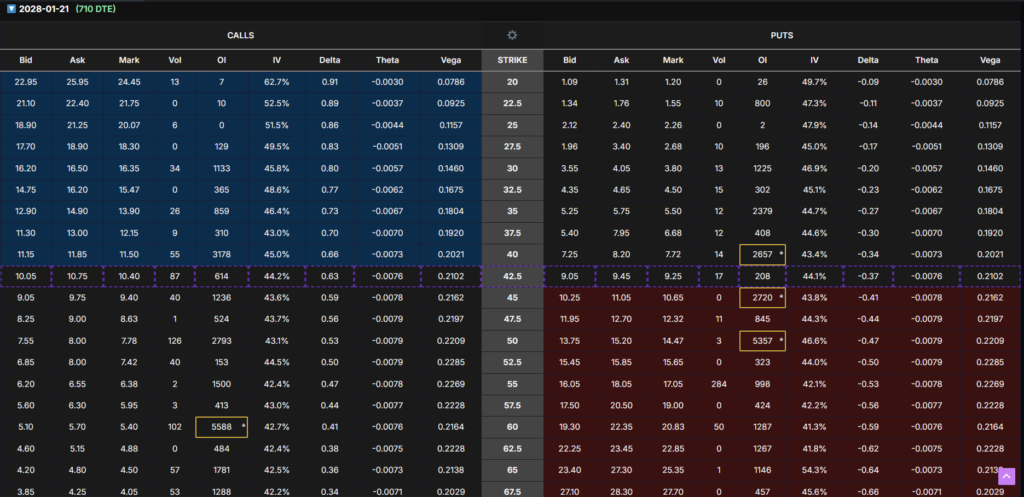

ITM LEAPS Strategy: Why We Chose the $30 Strike

Contract Selected

- Expiration: Jan 21, 2028 (~710 DTE)

- Strike: $30 Call

- Delta: ~0.80

- Profile: Stock-replacement LEAPS

Why $30 Over Higher Strikes

- High delta = stock-like exposure

- Lower theta decay during prolonged basing

- Less sensitivity to short-term volatility

- Tighter bid/ask and stronger liquidity

- Better suited for a slow re-rating thesis

📌 This is not a convex momentum bet. It is a time-and-patience trade.

Risk Management & Positioning Notes

- This is not a hold-to-expiration trade

- Reassess after structural improvements (weekly higher lows, MACD confirmation)

- Optional batch strategy:

- If the option price drops -40% to -50%, reassess before adding

- Position sizing should reflect capital intensity of deep ITM calls

Final Verdict

PayPal is experiencing maximum pessimism with intact fundamentals. When price, sentiment, analyst resets, and options structure align like this, asymmetric mean-reversion setups emerge — but only for those willing to use time as the edge.

The $30 ITM LEAPS call (710 DTE) expresses this view with discipline, durability, and clarity.

Disclaimer

This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Options trading involves risk and is not suitable for all investors. The author does not currently hold a position in PYPL at the time of writing. Always conduct your own research and consult a licensed financial advisor before making investment decisions.