Overview & Thesis

Procter & Gamble (PG) is currently trading near multi-month and multi-year lows after a prolonged period of valuation compression. Despite this price weakness, PG’s business fundamentals remain strong, with billions in free cash flow, high margins, strong returns on capital, and a well-covered dividend.

This disconnect between price action and business quality creates a compelling setup for a high-delta LEAPS call strategy, where we aim to profit from a mean-reversion rebound rather than a speculative breakout. The strategy focuses on capturing delta expansion and price recovery, not holding options until expiration.

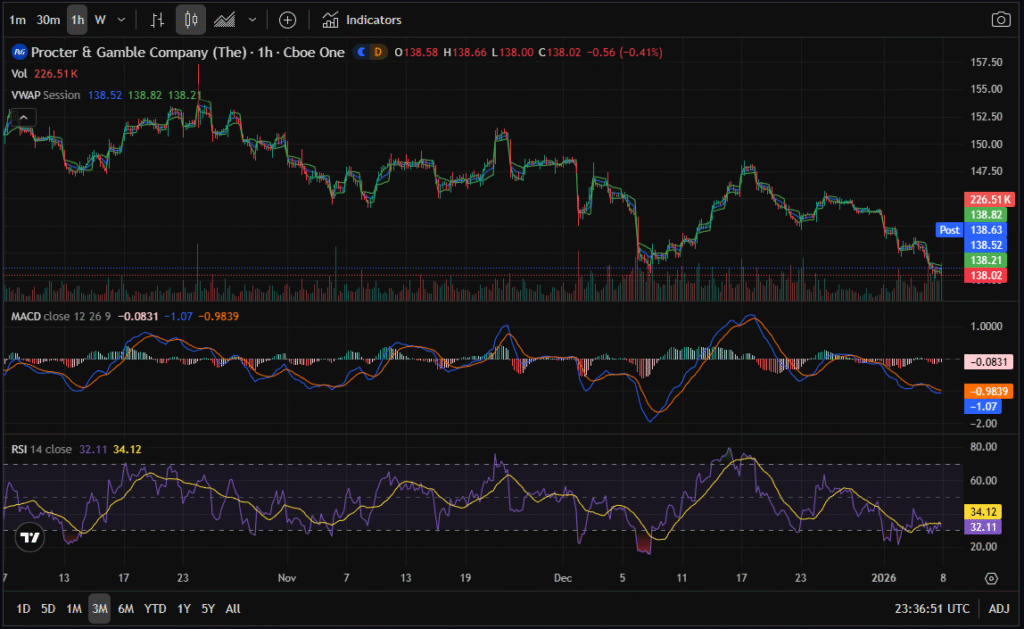

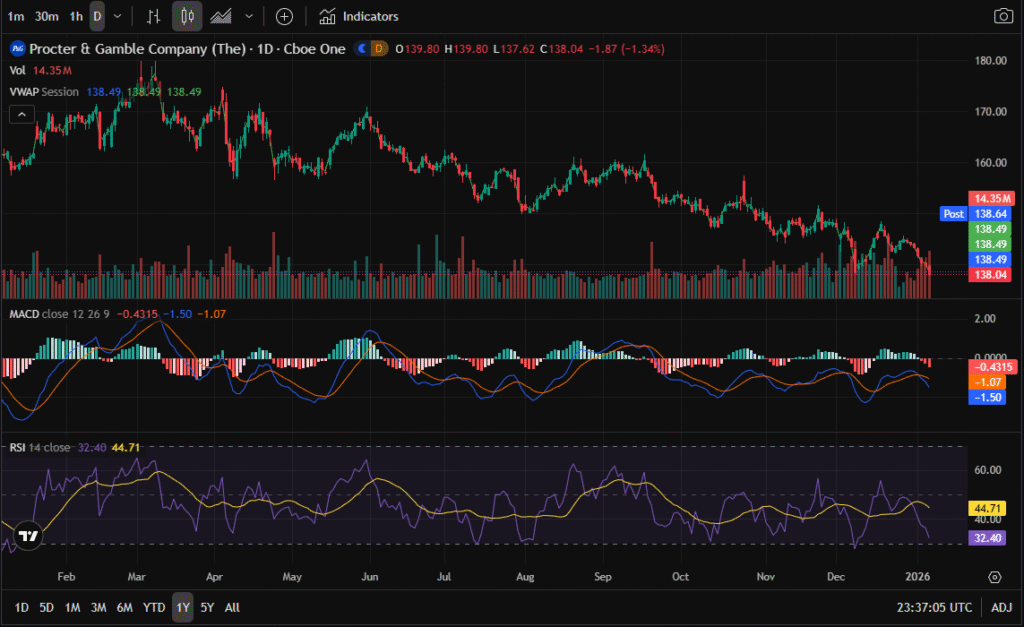

Technical Charts Analysis

From a multi-timeframe perspective:

- 3-Month Chart: PG is trading at a 3-month low with RSI near oversold territory. Momentum remains weak, but downside acceleration has slowed.

- 1-Year Chart: PG is at or near a 1-year low. MACD remains bearish, confirming the downtrend, but RSI is no longer extreme—suggesting selling pressure may be exhausting.

- 5-Year Chart: PG is testing a major structural support zone that has historically acted as long-term demand. Weekly RSI is near oversold levels, which is rare for a defensive consumer staples stock.

Technical conclusion:

This is not a confirmed reversal yet, but it is a high-attention zone where rebounds often originate, especially when fundamentals remain intact.

Financials & Fundamentals

PG’s financial profile remains exceptionally strong:

- Free Cash Flow (TTM): ~$15B

- Gross Margin: ~51%

- Operating Margin: ~24%

- Net Margin: ~20%

- ROE: ~32%

- ROIC: ~21%

- Debt-to-Equity: ~0.67

- Dividend Yield: ~3%

These metrics confirm that PG’s price decline is not driven by business deterioration, but by valuation compression and capital rotation. This is exactly the type of setup where long-dated, high-delta options can outperform.

News Headlines & Market Narrative

Recent headlines show:

- Minor institutional trimming, not mass exits

- PG underperforming while the broader market rallies

- Continued inclusion in dividend-focused investment commentary

There are no negative earnings warnings, margin collapse concerns, or balance-sheet stress signals in the news flow. The narrative is one of defensive sector fatigue, not company-specific risk.

Analyst Price Targets

Sell-side analysts have recently trimmed price targets, but importantly:

- Targets still cluster well above current price

- No coordinated downgrade wave

- Several firms maintain Buy or Neutral ratings

This indicates analysts are adjusting valuation assumptions, not abandoning the long-term thesis.

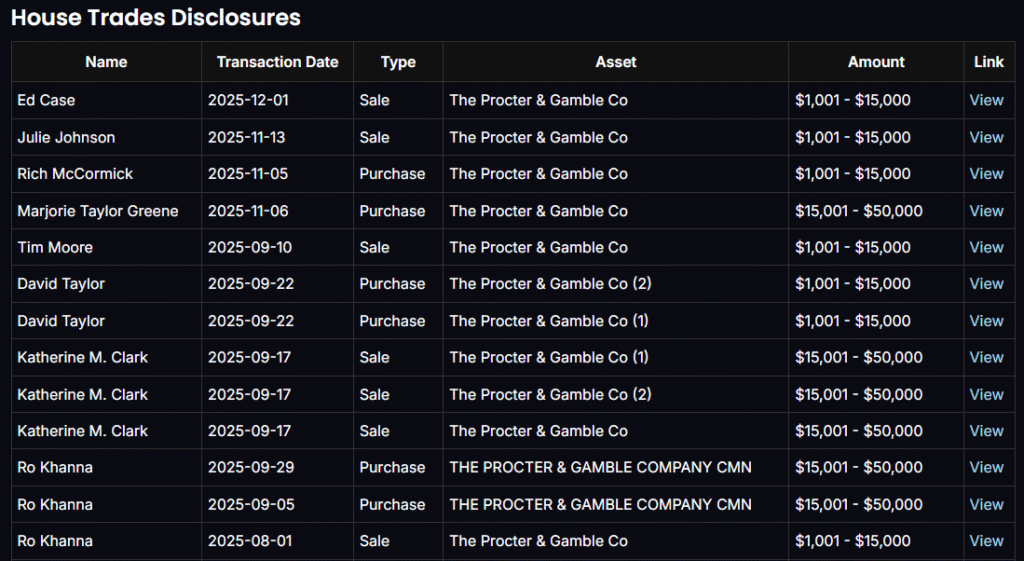

Insider, Senate & House Trading Activity

Key takeaway:

- No meaningful insider selling

- Executive transactions are mostly compensation-related

- Political trades are small, mixed, and non-informative

The absence of insider selling at multi-year support is quietly supportive of the long-term thesis.

Options Flow Analysis (Short-Term Context)

Short-dated options show:

- Heavy call open interest above spot

- Overhead resistance from call overwriting

- No evidence of aggressive short-term bullish speculation

This reinforces the idea that upside will likely be slow and grindy, not explosive—which further supports using long-dated LEAPS instead of short-term calls.

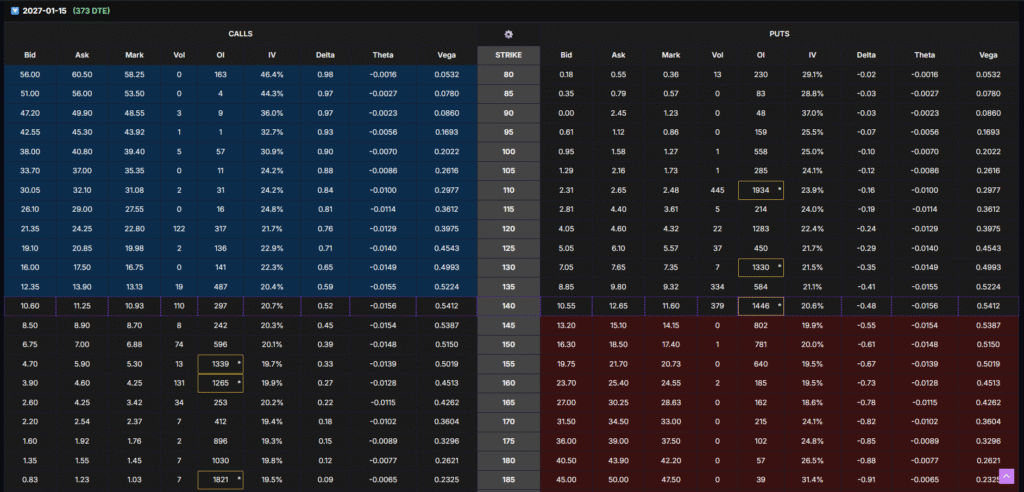

LEAPS Option Setup (Core Strategy)

We are targeting a deep-in-the-money LEAPS call with:

- Expiration: January 2027 (≈ 370–500 DTE range)

- Strike: $120 Call

- Delta: ~0.70–0.76

- Rationale:

- High delta allows us to profit primarily from price movement, not volatility speculation

- Deep ITM structure reduces reliance on IV expansion

- Lower risk of total premium decay compared to OTM calls

This strategy is designed to capture delta-driven gains as PG rebounds toward fair value.

Trade Management & Multi-Batch Entry Plan

We will not hold this option to expiration. The intent is to hold for a couple of months, or until the option reaches a substantial profit.

Batch Entry Framework

- Batch 1: Enter initial position now

- Batch 2: If the options price drops -40% to -50% from our first entry, we will re-analyze before adding

- Batch 3: If the options price of Batch 2 drops another -40% to -50%, we will re-analyze again to determine whether a third batch is justified

Important: When we reference a -40% to -50% drop, we are referring strictly to the options price, not the stock price.

Profit Targets

- Conservative target: +60%

- Primary target: +80%

- Extended target: +100%

As delta increases with a rising stock price, the option should appreciate at a multiple of the stock’s move, allowing us to exit well before expiration.

Roll Strategy

If PG fails to rebound within a few months:

- We will consider rolling the position into a later-dated LEAPS to maintain delta exposure while reducing time decay risk.

Risk Management & Position Sizing

- Maximum allocation: 2% of total portfolio

- Never over-concentrate capital in a single options position

- LEAPS reduce risk compared to short-dated calls, but loss of capital is still possible

Final Thoughts

This PG LEAPS setup is not a momentum trade. It is a structured rebound strategy built on:

- Strong fundamentals

- Oversold technicals

- Defensive sector rotation

- High-delta options positioning

The goal is controlled, asymmetric upside, not short-term speculation.

Disclaimer

This analysis is for informational and educational purposes only and does not constitute financial advice. I do not currently hold any position in Procter & Gamble (PG). Options trading involves risk and may result in the loss of principal. Always perform your own due diligence and consult a licensed financial advisor before making investment decisions. Never allocate more than 2% of your total portfolio to a single options trade.