Ticker: NTNX

Company: Nutanix, Inc.

Sector: Enterprise Cloud Infrastructure / Hybrid Cloud Software

Nutanix (NTNX) has entered a critical phase where price, sentiment, and positioning have sharply diverged from underlying fundamentals. After a steep multi-month drawdown, NTNX is now trading near 3-month, 1-year, and multi-year lows, despite improving cash flow, strong margins, and a maturing subscription business model. This article consolidates technical analysis, fundamentals, news sentiment, analyst behavior, insider activity, and options flow, and concludes with a structured ITM LEAPS strategy designed for risk-aware long-term positioning.

1. Multi-Timeframe Technical Analysis (3M / 1Y / 5Y)

3-Month Chart: Short-Term Pressure, Selling Momentum Slowing

NTNX is trading near a 3-month low, with price remaining below VWAP and key moving averages. RSI sits in the low-30s—weak but no longer in free fall. MACD remains bearish, but histogram compression suggests downside momentum is decelerating rather than accelerating.

📌 Interpretation: This is early base-building, not a confirmed reversal.

1-Year Chart: Oversold Conditions Emerging

On the 1-year timeframe, NTNX has broken prior support zones and entered a statistically oversold regime. RSI dipped into the mid-20s before stabilizing, a level historically associated with late-stage selloffs, not trend initiation. MACD remains negative, confirming that timing risk still exists.

📌 Interpretation: Valuation compression phase; patience required.

5-Year Chart: Long-Term Reset, Not Structural Breakdown

From a multi-year perspective, NTNX experienced a strong uptrend during its SaaS transition, followed by a sharp retracement. Weekly RSI is oversold, and while MACD is bearish, similar conditions in prior cycles preceded multi-quarter recoveries.

📌 Interpretation: Long-term value zone, but confirmation is pending.

2. Financials: Quietly Stronger Than Price Suggests

Despite the stock’s decline, Nutanix’s business fundamentals have materially improved:

- Positive Free Cash Flow: Now consistently positive in the hundreds of millions

- Gross Margin: High-80% range, comparable to top-tier enterprise SaaS peers

- Operating & Net Margins: Improving, transitioning toward sustainable profitability

- Returns: ROIC and ROA are no longer destructive, confirming execution discipline

📌 Key takeaway: NTNX is no longer a speculative turnaround—it is a cash-generating SaaS platform undergoing multiple compression.

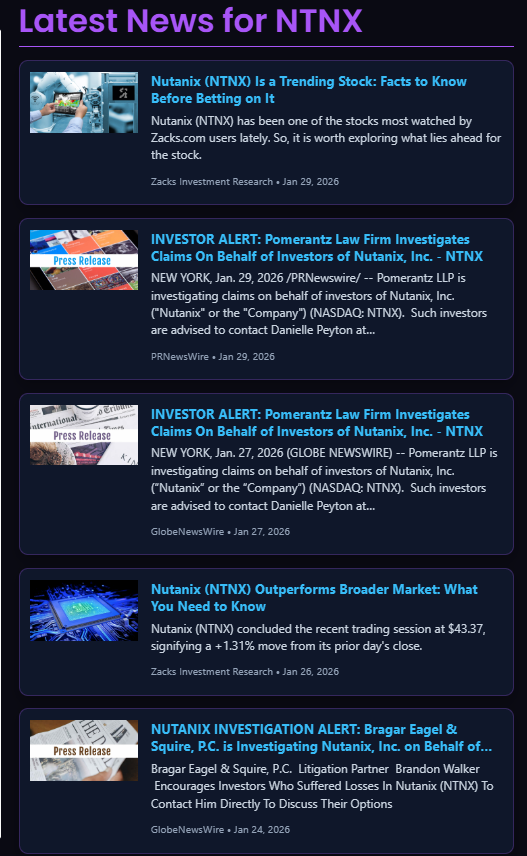

3. News & Sentiment: Headline Noise vs Business Reality

Recent headlines include:

- “Investor Alert” and law firm investigations

- “Trending Stock” and short-term performance mentions

These law firm announcements are routine post-drawdown solicitations, not SEC actions or fraud findings. Importantly, no earnings restatement, no regulatory enforcement, and no executive departures have occurred.

📌 Interpretation: Sentiment pressure, not fundamental deterioration.

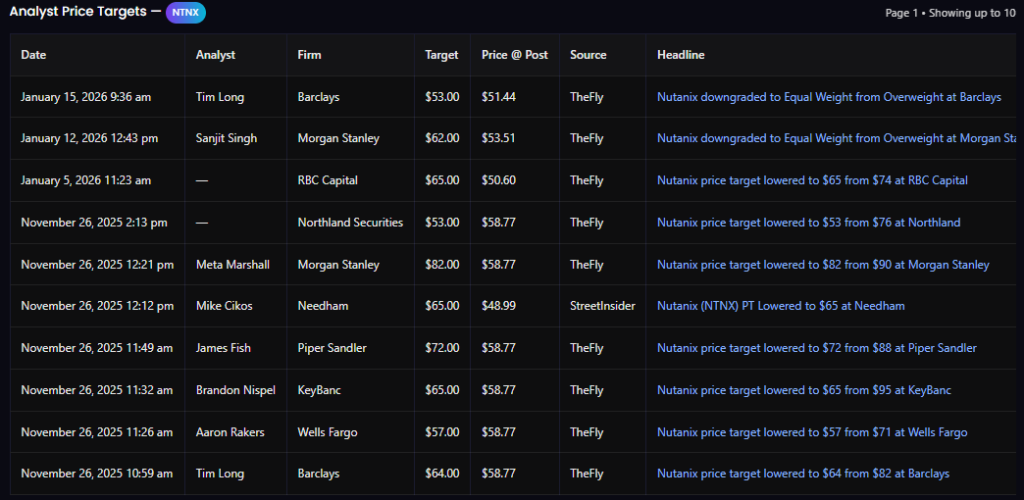

4. Analyst Price Targets: De-Risking, Not Abandonment

Analysts broadly cut price targets following the drawdown, moving from $70–$90 ranges down to $53–$65, while downgrading ratings to Equal Weight.

Crucially:

- No wave of Sell ratings

- Targets remain 35–65% above current price

- Coverage remains intact

📌 Interpretation: Analysts reset valuation models due to risk and volatility, not because the business is broken.

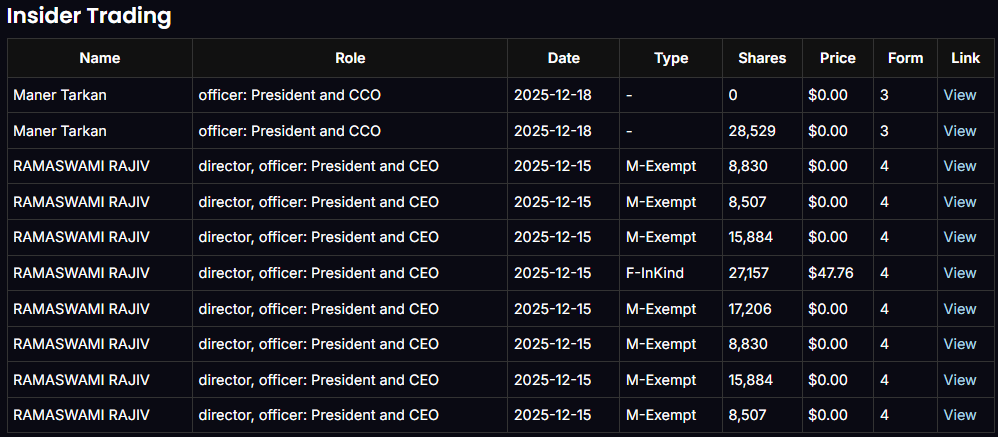

5. Insider & House Trading: Neutral, Not Bearish

Recent insider filings consist primarily of:

- RSU vesting

- In-kind grants

- Tax-related transactions

There have been no open-market insider buys, but also no panic selling. Congressional “house trades” are small, dated, and irrelevant to current price action.

📌 Interpretation: Management is observing, not signaling urgency.

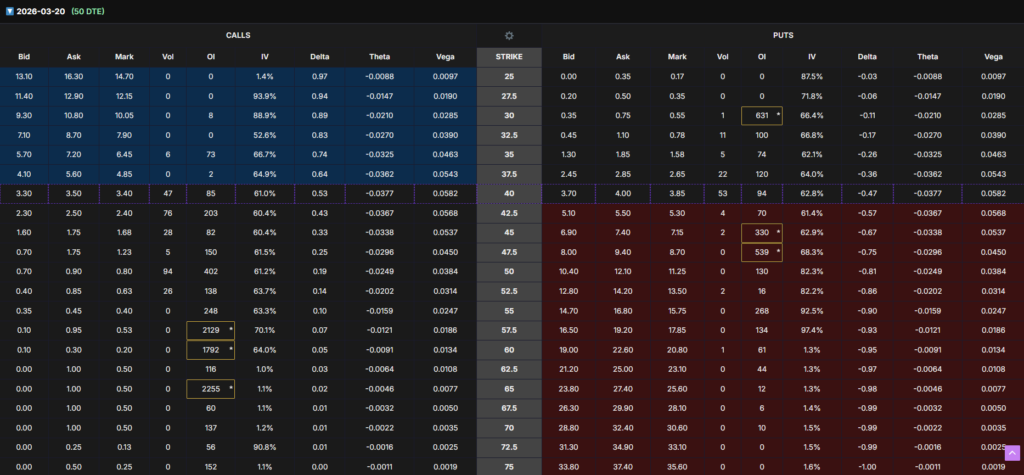

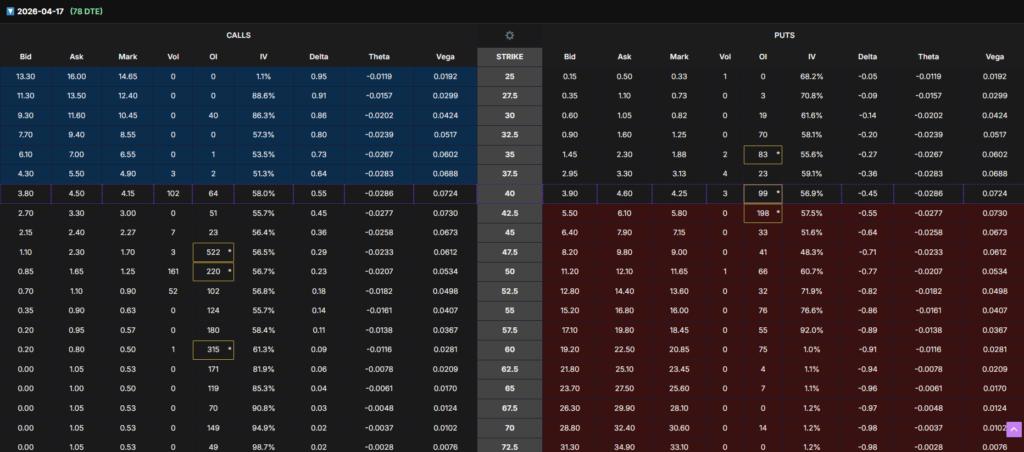

6. Options Flow Analysis: Time Matters

Short-dated options (22–50 DTE) show heavy put concentration near $40–45, indicating near-term caution and hedging. However, longer-dated expirations show stabilizing put pressure and selective call positioning, consistent with early mean-reversion expectations rather than aggressive bearish bets.

📌 Interpretation: Short-term bearish, long-term neutral-to-constructive.

7. ITM LEAPS Strategy: Structured, Not Speculative

Given:

- Oversold technicals

- Improving fundamentals

- Negative sentiment but no structural damage

- Mixed options flow with better signals in long-dated expirations

We are implementing a multi-batch ITM LEAPS strategy, designed to control timing risk while maintaining upside exposure.

Existing Position (Batch 1)

- Jan 2027 (351 DTE) $45 Call

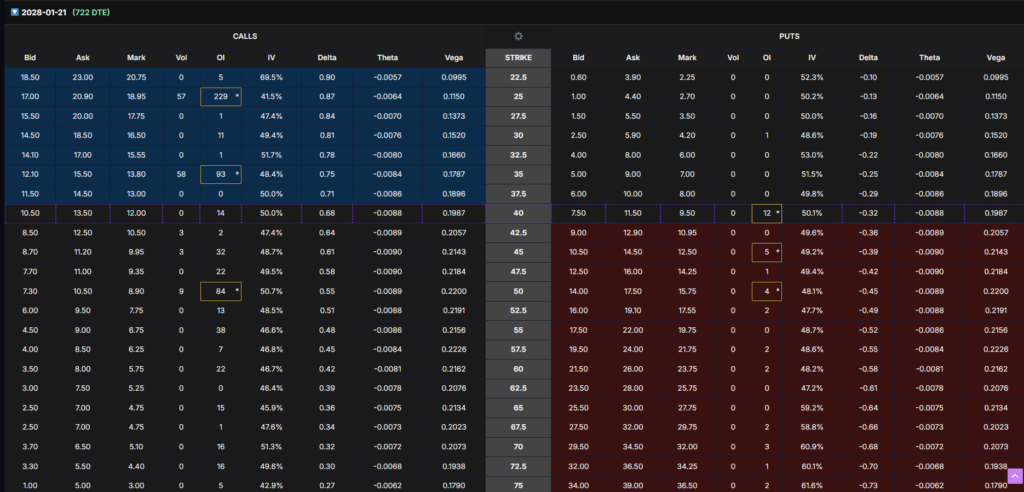

New Position (Batch 2 – Current Focus)

- Jan 2028 (722 DTE) $35 Call

- Delta ≈ 0.75

- Long duration reduces theta risk

- Strong intrinsic value component

- Adequate liquidity with rising participation

📌 Why this works:

This structure increases effective delta, extends time horizon, and avoids chasing short-term momentum. It is designed to benefit from normalization, not immediate reversal.

Final Thoughts

NTNX is not a momentum trade. It is a compressed, sentiment-damaged stock with improving fundamentals, still working through a bottoming process. The evidence supports measured exposure, not aggressive speculation.

This is precisely the environment where ITM LEAPS with long duration can outperform shares by providing leverage without forcing timing precision.

Disclaimer

This article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. The author does not currently hold a position in NTNX at the time of writing. Options trading involves significant risk and is not suitable for all investors. Past performance is not indicative of future results. Always conduct your own due diligence and consult a licensed financial advisor before making investment decisions.