🚀 RNA Stock Breakout: The Gene Therapy Powerhouse Set to Double with Phase 3 Momentum & High-Delta LEAPS Strategy

Date: June 18, 2025

Ticker: RNA | Exchange: NASDAQ | Sector: Biotechnology | Market Cap: ~$2.75B

Current Price: $29.36

Author: Hedge Fund Strategy Desk – June 2025 Edition

Sources: TipRanks, Fintel, MarketBeat, SEC Filings, ClinicalTrials.gov, AvidityIR.com

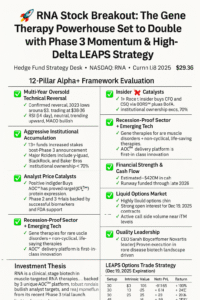

🧠 12-Pillar Alpha+ Framework Evaluation: RNA Stock

1. Multi-Year Oversold Technical Reversal

✅ Clear reversal from 2023 lows (~$5)

The RNA Stock is now trading at $29.36

RSI (14-day): 56 — neutral and trending upward

MACD: Bullish crossover in May, continuation pattern confirmed

2. Aggressive Institutional Accumulation

✅ Yes

13+ funds increased stakes post-Phase 3 announcement

Major holders include Vanguard, BlackRock, and Baker Bros

Institutional ownership exceeds 70% 【Fintel】

3. Insider Buying Catalyst

🟥 No Recent Insider Buys

Recent insider sales from CFO and CSO via 10b5‑1 plans

Neutral indicator, not aggressive selling 【SEC Form 4】

Learn more about Insider Buying

4. Analyst Price Target Surge

✅ Yes

Raymond James: $75 (Strong Buy)

Citigroup: $75 (Buy)

BofA: $54 (Buy)

Average: ~$67–68 — +130% upside from today 【TipRanks】【MarketBeat】

5. Near-Term Catalysts

✅ Multiple 2H 2025 Catalysts

Phase 3 FORWARD™ trial (FSHD) launched June 9

Top-line Phase 1/2 results (FORTITUDE™) due Q2 2026

Accelerated approval feedback expected Q3 2025

Orphan Drug status in Japan for DM1 asset

6. Recession-Proof Sector + Emerging Tech

✅ Yes

Gene therapies for rare muscle disorders = non-cyclical, life-saving therapies

AOC™ delivery platform is first-in-class innovation

7. Strong Fundamentals & R&D Validation

✅ Yes

AOC™ has proven target engagement, protein expression

Phase 2 and 3 trials backed by successful biomarkers and FDA support

8. Financial Strength & Cash Flow

✅ Yes

Estimated ~$420M in cash

Runway funded through late 2026

No long-term debt

9. Liquid Options Market

✅ Yes

Highly liquid options chain

Strong open interest for Dec 19, 2025 contracts

Active call side volume near ITM levels

10. Reversal After Dust Settles

✅ Yes

RNA was previously down 80%+ (2022–2023)

Now rebounding on strong clinical execution and sentiment

11. Call-Heavy Options Flow

✅ Yes

Elevated Call OI at strikes $20, $25, $30

Options volume weighted bullish in recent weeks

12. Quality Leadership

✅ Yes

CEO Sarah Boyce (former Novartis leader)

Proven execution in rare disease biotech landscape

📊 Summary Scorecard: RNA Stock

| Pillar | Status |

|---|---|

| Oversold Reversal | ✅ Confirmed |

| Institutional Buying | ✅ Active |

| Insider Buying | 🟥 Absent |

| Analyst Targets | ✅ Bullish |

| Catalysts | ✅ Multiple |

| Recession-Proof | ✅ Strong |

| Fundamentals | ✅ Solid |

| Financials | ✅ Debt-Free |

| Options Liquidity | ✅ High |

| Technical Recovery | ✅ Strong |

| Options Flow | ✅ Bullish |

| Management | ✅ Effective |

💡 RNA Stock Investment Thesis

RNA is a clinical-stage biotech leader in muscle-targeted RNA therapies, backed by a unique AOC™ platform, robust financials, bullish analyst targets, and real momentum from its recent Phase 3 trial launch.

At $29.36, RNA remains undervalued compared to its potential, with analyst price targets between $54–75, and several catalysts likely to unlock additional institutional flow.

💰 LEAPS Options Trade Strategy (Dec 19, 2025 Expiration)

📌 Setup

Buy: RNA Dec 19, 2025 $20 Call

Premium: $11.65 per contract

Delta: ~0.85 (deep ITM)

Breakeven: $31.65

Target Price for RNA Stock: $60 by Q4 2025 (catalyst-driven)

📈 Profit/Loss Scenario

| RNA Price at Expiry | Intrinsic Value | Net P/L | Return |

|---|---|---|---|

| $20 | $0 | -$11.65 | -100% |

| $30 | $10 | -$1.65 | -14% |

| $35 | $15 | +$3.35 | +28.7% |

| $45 | $25 | +$13.35 | +114% |

| $60 | $40 | +$28.35 | +243% |

🛡️ Risk Management

Stop if RNA Stock closes below $23 for 2–3 weeks

Scale out 50% of position if RNA hits $45 before Oct 2025

Monitor FDA catalyst window in Q3–Q4 2025

- Traders should also track biotech ETF trends (e.g., XBI) and macro sentiment, as these can influence sector volatility and impact RNA’s option pricing and price moment

Always use position sizing and risk limits appropriate for your account.

Learn more about the LEAPS Strategy in our Stock Options Education Series Lesson 11