NTLA LEAPS ITM CALL Strategy Update #1

🔍 Analyst Sentiment & Price Targets

Benzinga reports 9 analysts covering NTLA: 6 bullish, 2 neutral, 1 moderately bullish. The average 12‑month price target is $33.11, with a range from $10 to $68. However, the average target has been trimmed by 14.8% recently morningstar.com+15benzinga.com+15marketbeat.com+15.

HC Wainwright & Co. reaffirmed a Buy rating with an unchanged $30 target on June 16 gurufocus.com+1benzinga.com+1.

MarketBeat shows a consensus “Moderate Buy,” with an average target of $34.95 (low $7, high $68), implying ~+300% upside ainvest.com+2marketbeat.com+2gurufocus.com+2.

📈 Recent Price Action & Technicals

NTLA is trading between $8.25–$9.11 today, high volatility zone. Volume is elevated at ~4–5 million shares, well above the ~2.8M average finance.yahoo.com+8marketbeat.com+8morningstar.com+8.

StockTradersDaily notes key levels: buy around $7.70 support, next resistance at $8.35 (with breakout target ~$8.98), and intraday resistance at $8.47, stop losses around 8.45–8.68 news.stocktradersdaily.com.

🧬 Fundamental & Trial News: NTLA LEAPS

On June 15, Intellia reported positive three‑year Phase 1 data for its NTLA‑2002 therapy (hereditary angioedema), boosting confidence nasdaq.com+14tipranks.com+14en.wikipedia.org+14.

Earlier signals from TipRanks suggest strong NTLA‑2002 efficacy, prompting H.C. Wainwright’s upgraded Buy stance tipranks.com+1tipranks.com+1.

🚨 Volume & Catalysts

AInvest analysis from early June flagged a ~5.7% spike that lacked technical triggers—driven instead by volume (~1.6M shares, 3× average), possibly due to sector rotation or whispers preceding the trial data ainvest.com.

🧾 Fundamentals at a Glance

Source: TradingView & MarketBeat timothysykes.com+3marketbeat.com+3news.stocktradersdaily.com+3

| Metric | Value |

|---|---|

| Market Cap | ~$861M–$929M |

| YTD Price Change | –26% |

| 1‑Year Price Change | –66% |

| Next Earnings Date | July 31, 2025 |

| Revenue (TTM) | ~$45M |

| Net Income (TTM) | –$481M to –$519M |

| Cash Ratio | ~6.7× |

| Target Price Upside | ~+300% to $35± |

🧭 Summary & Outlook for NTLA LEAPS Strategy

Strong Analyst Conviction: Sustained bullish sentiment with price targets averaging ~$33–35—pointing to substantial upside.

Clinical Catalyst in Play: Positive Phase 1 data for NTLA‑2002 is fueling the narrative, alongside broader CRISPR/biotech revival.

Technical Setup: Standout support at ~$7.70; key resistance at $8.35–8.47, with short-term breakout potential.

Risk Profile: Still early-stage, loss-making, highly volatile (beta ~2.2). Cash buffers help, but speculative biotech nature remains.

✅ What Investors Should Watch

Breakouts above $8.47 on volume—could signal a swing trade with a target near $8.98.

Sustained performance post-data release—especially as NTLA-2002 progresses.

Upcoming earnings (July 31) for updated commercial/revenue guidance.

Downside protection—support near $7.70; a break below could test the next level.

🏁 Final Take: NTLA LEAPS

NTLA is a high-risk, high-reward biotech with core strengths in CRISPR gene editing. With bullish analyst views and phase 1 trial momentum, there’s potential for a significant rebound. But volatility remains high—consider clear entry/exit levels and size positions cautiously.

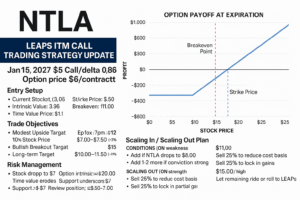

Here’s a NTLA LEAPS ITM Call Trading Strategy Update for Intellia Therapeutics (NTLA) using the:

🎯 NTLA Jan 15, 2027 $5 Call

📈 Delta: 0.86

💵 Premium: $6.00 per contract

📅 Days to Expiration: ~578 days

📊 Current Stock Price: $8.96 (as of June 16, 2025)

⚙️ Strategy Thesis: Deep ITM NTLA LEAPS Call (High Delta, High Conviction)

This trade is designed for long-term directional exposure to NTLA LEAPS with significantly less capital than buying shares, but with a stock-like movement due to the high delta (0.86).

📌 Entry Setup

| Parameter | Value |

|---|---|

| Stock Price | $8.96 |

| Strike Price | $5.00 |

| Intrinsic Value | $3.96 |

| Time Value Paid | $2.04 ($6.00 – $3.96) |

| Breakeven Price | $11.00 (Strike + Premium) |

| Delta (approximate) | 0.86 |

| Leverage Multiplier | ~5x compared to buying stock |

📈 Trade Objectives

| Objective | Target Price | Option Value Est. | ROI Est. |

|---|---|---|---|

| Modest Upside Target | $12.00 | ~$7.00–$7.50 | +16%–25% |

| 10% Stock Move (to $9.86) | ~$6.90 | +15% | |

| Bullish Breakout Target | $15.00 | ~$10.00–$11.50 | +66%–91% |

| Long-term Target | $20–$25 | $15–$20 | +150–230% |

📉 Risk Management

| Risk Scenario | Description |

|---|---|

| Stock drops to $7.00 | Option intrinsic ≈ $2.00, time value erodes |

| Support breach <$7 | Review position; possible scale-in at $6.50–$7.00 |

| Stock drops below $5 | Entire option becomes OTM, potential full loss |

You only risk $600 per contract, vs. $896 for 100 shares.

🔁 Scaling In / Scaling Out Plan: NTLA LEAPS

🔹 Scaling In (on weakness)

| Condition | Action |

|---|---|

| NTLA drops to $8.00 | Add more contracts (Avg. cost <$6) |

| NTLA hits $7.00 | Add 1–2 more (if conviction strong) |

| < $6.00 | Reassess fundamentals & support |

🔸 Scaling Out (on strength)

| Trigger Price | Action |

|---|---|

| $11.00 | Sell 25% to reduce cost basis |

| $13.00 | Sell 25% to lock in partial gains |

| $15.00+ | Let remaining ride or roll to higher LEAPS |

✅ Why This Setup Works for NTLA

✅ High Delta (0.86) behaves like owning stock.

✅ Limited downside to premium paid.

✅ Large upside potential if NTLA recovers toward analyst targets ($30–$35).

✅ Positive clinical news and insider/institutional interest recently.

✅ Strong long-term catalyst (CRISPR + NTLA-2002 + pipeline).

🧠 Optional Enhancements: NTLA LEAPS

🔁 Roll Strategy: If NTLA hits $15–$18 by mid-2026, roll to Jan 2029 $10 Calls for extended upside.

🛡️ Hedge Strategy: Pair with short OTM Calls (e.g., Jan 2026 $17) for a diagonal if IV rises.

Learn more about LEAPS strategy from our Stock Options Education Series.