:

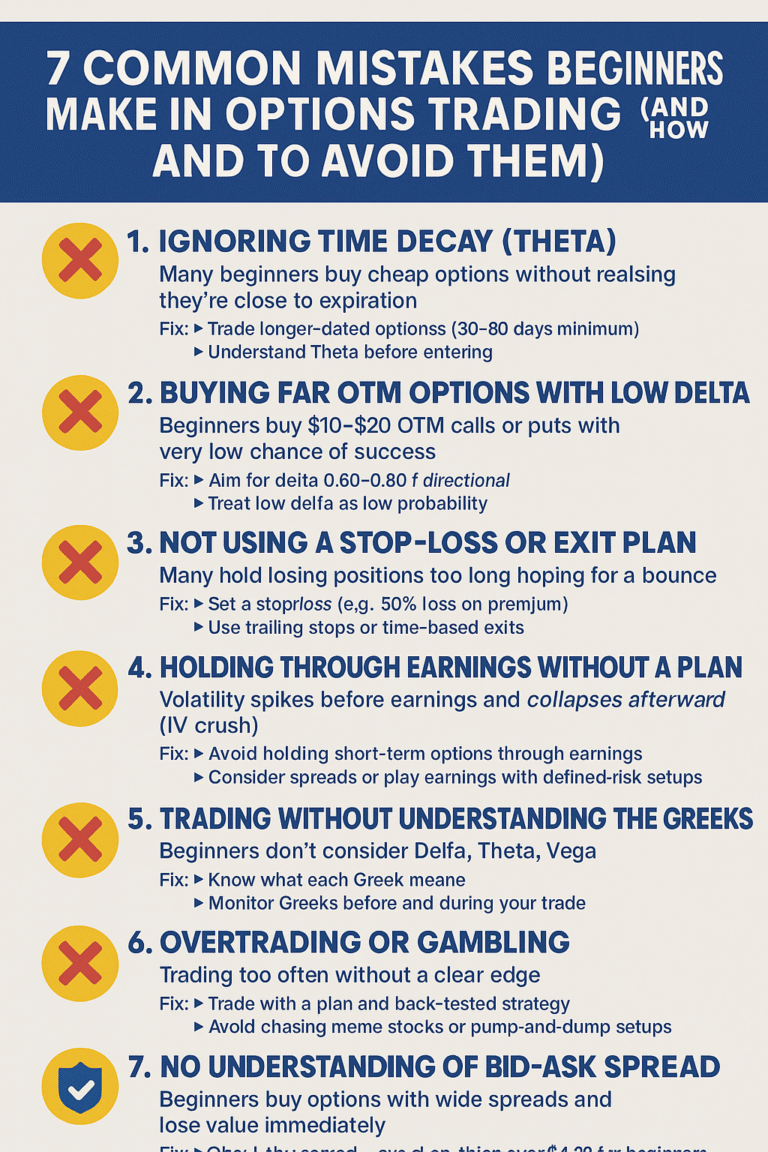

📘 Lesson 8: 7 Common Mistakes Beginners Make in Options Trading (and How to Avoid Them)

🧠 Core Concept

Options trading offer big rewards—but also carry unique risks. Many beginners lose money not because options are bad, but because they make common avoidable mistakes.

This lesson will help you identify and avoid the traps that cause most new traders to fail.

❌ 1. Ignoring Time Decay (Theta)

- Many beginners buy cheap options without realizing they’re close to expiration

- Each day, options lose value (even if the stock stands still)

Fix:

➤ Trade longer-dated options (30–90 days minimum)

➤ Understand Theta before entering

❌ 2. Buying Far OTM Options With Low Delta

- Beginners buy 10–20 delta OTM calls or puts with very low chance of success

- These options are cheap but often expire worthless

Fix:

➤ Aim for delta 0.60–0.80 if directional

➤ Treat low delta as low probability

❌ 3. Not Using a Stop-Loss or Exit Plan

- Many hold losing positions too long hoping for a bounce

- Options lose value fast and can go to $0

Fix:

➤ Set a stop-loss (e.g., 50% loss on premium)

➤ Use trailing stops or time-based exits

Learn more about Options Exit Plans

❌ 4. Holding Through Earnings Without a Plan

- Volatility spikes before earnings and collapses afterward (IV crush)

- Even correct stock direction can still result in loss

Fix:

➤ Avoid holding short-term options through earnings

➤ Consider spreads or play earnings with defined-risk setups

❌ 5. Trading Without Understanding the Greeks

- Beginners don’t consider Delta, Theta, Vega

- They don’t know why their option loses value even if the stock moves

Fix:

➤ Know what each Greek means

➤ Monitor Greeks before and during your trade

❌ 6. Overtrading or Gambling

- Options trading too often without a clear edge

- Placing bets based on social media hype or rumors

Fix:

➤ Trade with a plan and back-tested strategy

➤ Avoid chasing meme stocks or pump-and-dump setups

❌ 7. No Understanding of Bid-Ask Spread

- Beginners buy options with wide spreads and lose value immediately

Fix:

➤ Check the spread — avoid anything over $0.20 for beginners

➤ Use limit orders, not market orders

🛡️ Bonus Tip: Start With Paper Options Trading

- Practice on a simulated account first

- Test your knowledge without risking real money

✅ Common Options Trading Mistakes Quiz

- What Greek tells you how much value you lose each day?

- Why do OTM options with low delta often fail?

- What happens after earnings that hurts option buyers?

🧠 Answers

- Theta

- They have low probability of expiring ITM

- IV Crush — implied volatility drops, killing premium value

View more of our lessons in our Stock Options Education Series