SPX Iron Condor Expiry Day Update: Max Profit in Sight (July 11, 2025)

VIXTradingHub Analysis

📝 VIXTradingHub Analysis

✅ SPX Iron Condor Expiry Day Update: Max Profit in Sight (July 11, 2025)

Strategy: 2DTE SPX Iron Condor

Entry Date: July 9, 2025

Expiration: July 11, 2025 (0DTE)

Max Profit Target: $3,115

Max Risk: $3,885

Result: 🟢 SPX trading inside max profit zone as of 10:09 AM ET

🧠 Original Trade Structure for SPX Iron Condor

| Leg | Strike | Delta | Note |

|---|---|---|---|

| Short Call | 6270 | ~0.45 | Key resistance cluster |

| Long Call | 6340 | ~0.05 | OTM protection |

| Short Put | 6260 | ~-0.45 | At-the-money support |

| Long Put | 6190 | ~-0.10 | OTM protection |

| Credit Received | $31.15 | R/R ≈ 0.80 |

📊 Max Profit Zone: SPX closes between 6260 and 6270

📉 Breakeven Zone: 6221.15 – 6308.85

Learn More on Calculating Options Max Profit at InsiderFinance.io

📈 Market Snapshot – July 11 @ 10:09 AM ET

-

SPX Last Price: 6253.40

-

Intraday Change: –27.06 (–0.43%)

-

VIX: 15.90

-

Theta: Fully engaged – 0DTE

-

Volatility Catalyst Risk: ✅ Avoided (Fed minutes & tariffs priced in)

🟢 SPX remains within the core of the Iron Condor range, setting up for a maximum profit close if it stays above 6260 and below 6270.

🔍 Open Interest Analysis (Support & Resistance)

| Strike | OI Type | Open Interest | Interpretation |

|---|---|---|---|

| 6275 | Call | 3.465k | Strong resistance wall |

| 6260 | Put | 2.657k | Pin zone, strong base |

| 6250 | Put | 2.999k | Confirmed floor |

| 6225 | Put | 3.008k | Deepest support layer |

📊 Support Zone: 6225–6250

📊 Resistance Zone: 6270–6275

✅ SPX is parked inside this high open interest “magnet zone,” favoring a pin expiration outcome.

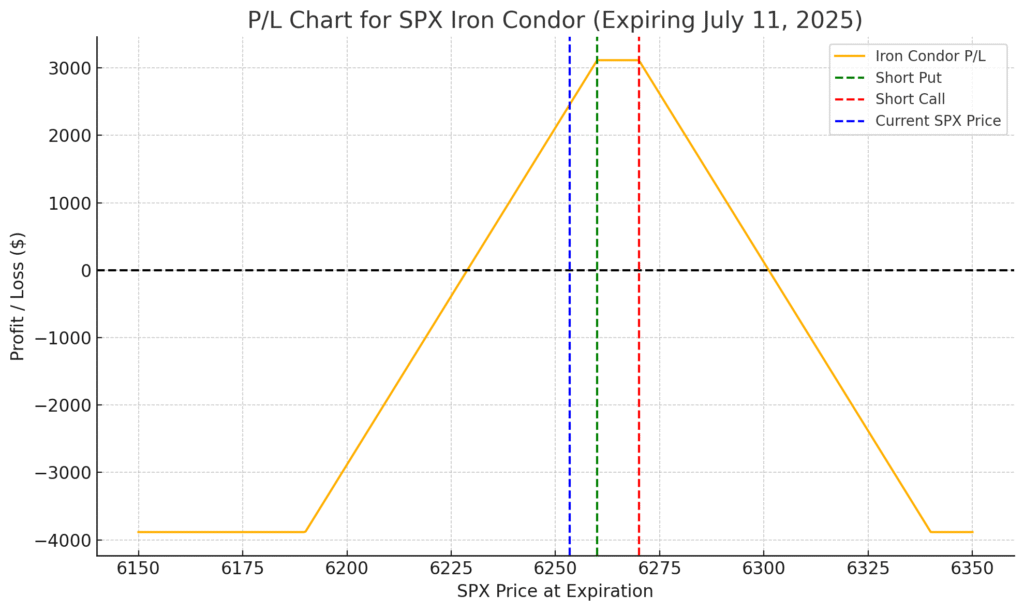

📉 SPX Iron Condor Real-Time Profit/Loss Chart

![P/L Chart Attached Above]

-

Green dashed line: Short Put (6260)

-

Red dashed line: Short Call (6270)

-

Blue dashed line: Current SPX Price (6253.40)

📍 The profit plateau is visible between the short strikes. Any close inside that range will lock in the full $3,115.

⏱️ Execution Guidance

-

Hold the position through midday if SPX remains in the 6260–6270 zone

-

Consider closing by 2pm ET for 70% of max profit

-

Set alerts if SPX drops below 6250 or rises above 6275 to manage breakout risk

-

Avoid holding into the final 60 minutes

- Do not be greedy and has no fear of Gamma risk

| 6270 |

📘 Final Takeaway: SPX Iron Condor

This trade played out by the book:

-

✅ Low IV at entry

-

✅ Centered delta structure

-

✅ Solid open interest pin zone

-

✅ No surprise catalysts

-

✅ Theta-driven decay

As long as SPX closes between 6260 and 6270 today, full max profit of $3,115 is yours.

This confirms the power of high-conviction Iron Condors under 2DTE, when structured with proper hedge fund-style filters.

📅 Trade Date: July 9, 2025

📆 Expiry: July 11, 2025

📍 Posted by: VIXTradingHub – Precision Options Flow & Strategy

Here’s a step-by-step guide to safely and efficiently close your 4-leg SPX Iron Condor (expiring today, July 11, 2025):

✅ Goal: Close the Iron Condor to realize profit and eliminate expiration risk

🛡️ You want to avoid assignment risk and any last-hour market spike or crash.

🧰 Step-by-Step: Closing the Iron Condor

🧾 Step 1: Confirm Your Current Position

Log into your broker platform and verify you have:

| Leg | Action | Symbol | Strike |

|---|---|---|---|

| Short Put | –1 | SPXW 11JUL25 P | 6260 |

| Long Put | +1 | SPXW 11JUL25 P | 6190 |

| Short Call | –1 | SPXW 11JUL25 C | 6270 |

| Long Call | +1 | SPXW 11JUL25 C | 6340 |

📐 Step 2: Select “Close Position” or “Create Opposite Order”

In your trading platform:

-

Go to your Options tab or Positions tab

-

Click on your Iron Condor position (or select each leg manually)

-

Choose “Close” or “Create opposite order”

This means:

-

Buy to Close the short put (6260)

-

Sell to Close the long put (6190)

-

Buy to Close the short call (6270)

-

Sell to Close the long call (6340)

✅ You are unwinding all 4 legs at once in a single multi-leg order.

📊 Step 3: Use a Net Debit Order

You sold to open the Iron Condor for $31.15 credit, so you will:

-

Buy to close the entire spread for a debit (hopefully much lower than $31.15)

-

Target a net debit close of $1.00 or less for 90–97% profit lock-in

💡 If SPX stays between 6260–6270, the spread should be trading for just pennies near EOD.

🛠️ Step 4: Set Order Type = “LIMIT”

-

Use Limit Order, not Market Order

-

Suggested limit price = $0.50 – $1.00 for 90%+ profit

-

Do NOT use “Market” unless spreads are ultra-tight and you’re minutes from expiration

🕐 Step 5: Time Your Exit

Ideal close timing:

-

Between 2:00 – 3:30 PM ET

-

Ensure SPX is still between 6260 – 6270

✅ Most time decay will be realized, and liquidity remains strong before the final 30 mins.

🧪 Step 6: Verify Execution & P/L

Once filled:

-

Check that all 4 legs have closed out

-

Confirm realized P/L: should be very close to +$3,000+ if debit close is under $1.00

📌 Step 7: Log the Trade

Record:

-

Entry date: July 9

-

Exit date: July 11

-

Net Credit: $31.15

-

Close Debit: (e.g. $0.80)

-

Net Profit: $30.35 per contract = $3,035 per spread

Optional: save a screenshot of the chart and trade history for journal or case study.

⚠️ Backup Plan (if SPX nears short strikes)

-

If SPX crosses 6260 or 6270:

-

Close early to avoid ITM assignment (even though SPX is cash-settled, avoid unnecessary exposure)

-

Or adjust by rolling the breached side (advanced)

-

Here’s a clear and professional step-by-step guide on how to roll down the put vertical (and optionally the call vertical) on your SPX Iron Condor if the put side is being attacked — while preserving a delta-neutral bias.

🔁 Rolling Adjustments for SPX Iron Condor (Same Expiry or Later)

🎯 Goal:

-

Reduce directional delta if market drops below short put (6260)

-

Adjust the Iron Condor to remain delta-neutral

-

Avoid max loss by repositioning the wings

🛠️ Scenario: SPX Drops Below 6260

Your short put (6260) is now ITM or close, increasing risk.

✅ STEP-BY-STEP: ROLL DOWN PUT VERTICAL

🔧 Step 1: Close the Existing Put Vertical

You’re currently holding:

-

Short Put: 6260

-

Long Put: 6190

🔁 You will:

-

Buy to Close 1x SPXW P 6260

-

Sell to Close 1x SPXW P 6190

📦 Done as a vertical debit order (it will cost money to close if ITM)

🎯 This removes the breached side.

➕ Step 2: Open a New Lower Put Vertical

Pick a lower range, e.g.:

-

Sell to Open 1x SPXW P 6240

-

Buy to Open 1x SPXW P 6170

🛠️ Criteria:

-

Choose strikes 20–30 pts lower to re-center the spread

-

Maintain same width (e.g., 70 pts) to control max loss

-

Check deltas: aim for new short put delta ~0.30–0.45

✅ Enter as a new credit vertical, ideally receiving premium to offset your earlier debit close.

⚖️ Step 3 (Optional): Roll Down the Call Vertical Too (for Delta-Neutral Balance)

If SPX drops and your position becomes bearishly unbalanced, you can:

Roll Down:

-

Buy to Close 6270 Call

-

Sell to Close 6340 Call

-

Sell to Open 6240 Call

-

Buy to Open 6310 Call

✅ Now you’ve rolled both wings down, keeping them equidistant around current SPX

✅ Helps re-center the Iron Condor for delta-neutrality

⏳ Step 4: Match Expiry

-

You may stay with same expiry (if enough time premium exists)

-

Or consider rolling to a later expiry (e.g., Monday July 15) for more time and better credit

📊 Step 5: Verify New Risk Profile

After rolling:

-

Confirm max profit, max loss, new breakeven zone

-

Evaluate whether to scale out or hold full position

-

Monitor new deltas on both legs

🧠 Example Summary:

| Action | Legs | Result |

|---|---|---|

| Close Put Spread | 6260/6190 | Removes threatened wing |

| Open New Put Spread | 6240/6170 | Adds safer lower wing |

| (Optional) Roll Call Spread | 6270/6340 → 6240/6310 | Re-centers delta |

| Match Expiry | 07/11 or extend to 07/15 | Choose based on premium |

🧾 Execution Tip:

-

Use “multi-leg order” or “spread trader” tool on your broker

-

Trade all legs in one order ticket when possible to control slippage

📘 Recap: Rolling Down for Defense + Delta Neutral

| Goal | Action |

|---|---|

| Defend downside breach | Roll down put spread |

| Reduce bearish delta | Roll down call spread too |

| Maintain Iron Condor shape | Keep same wing width |

| Extend theta decay | Optional: roll out in time |

If You would like to learn how to master the Iron Condor strategy then visit Lesson 13 of our Stock Options Education Series

Chart

Financials

No financial data available for SPX.

News & Opinions

No opinion articles found for SPX.

Options Chain

Technical Ratings

📊 Technical Analysis Overview

Auto-loaded insights for today’s featured stock

Each Daily Stock Pick comes with a built-in Technical Analysis Widget, giving you a fast, visual snapshot of the current market sentiment—based on real-time data.

🔎 What You’ll See:

Overall Signal:

A summary at the top:

✅ Strong Buy, 📈 Buy, ⚖️ Neutral, 📉 Sell, or ❌ Strong SellTimeframes:

Switch between views (1min, 15min, 1hr, Daily, Weekly) to match your trading style—short-term or long-term.Breakdown of Indicators:

Moving Averages – trend-following tools

Oscillators – momentum indicators like RSI & MACD

Pivots – support and resistance levels

💡 How to Use It:

This widget helps confirm or challenge your trading bias. Use it together with:

Our price targets

Options flow & volatility analysis

Institutional and insider sentiment

📝 VIXTradingHub Analysis

✅ SPX Iron Condor Expiry Day Update: Max Profit in Sight (July 11, 2025)

Strategy: 2DTE SPX Iron Condor

Entry Date: July 9, 2025

Expiration: July 11, 2025 (0DTE)

Max Profit Target: $3,115

Max Risk: $3,885

Result: 🟢 SPX trading inside max profit zone as of 10:09 AM ET

🧠 Original Trade Structure for SPX Iron Condor

| Leg | Strike | Delta | Note |

|---|---|---|---|

| Short Call | 6270 | ~0.45 | Key resistance cluster |

| Long Call | 6340 | ~0.05 | OTM protection |

| Short Put | 6260 | ~-0.45 | At-the-money support |

| Long Put | 6190 | ~-0.10 | OTM protection |

| Credit Received | $31.15 | R/R ≈ 0.80 |

📊 Max Profit Zone: SPX closes between 6260 and 6270

📉 Breakeven Zone: 6221.15 – 6308.85

Learn More on Calculating Options Max Profit at InsiderFinance.io

📈 Market Snapshot – July 11 @ 10:09 AM ET

-

SPX Last Price: 6253.40

-

Intraday Change: –27.06 (–0.43%)

-

VIX: 15.90

-

Theta: Fully engaged – 0DTE

-

Volatility Catalyst Risk: ✅ Avoided (Fed minutes & tariffs priced in)

🟢 SPX remains within the core of the Iron Condor range, setting up for a maximum profit close if it stays above 6260 and below 6270.

🔍 Open Interest Analysis (Support & Resistance)

| Strike | OI Type | Open Interest | Interpretation |

|---|---|---|---|

| 6275 | Call | 3.465k | Strong resistance wall |

| 6260 | Put | 2.657k | Pin zone, strong base |

| 6250 | Put | 2.999k | Confirmed floor |

| 6225 | Put | 3.008k | Deepest support layer |

📊 Support Zone: 6225–6250

📊 Resistance Zone: 6270–6275

✅ SPX is parked inside this high open interest “magnet zone,” favoring a pin expiration outcome.

📉 SPX Iron Condor Real-Time Profit/Loss Chart

![P/L Chart Attached Above]

-

Green dashed line: Short Put (6260)

-

Red dashed line: Short Call (6270)

-

Blue dashed line: Current SPX Price (6253.40)

📍 The profit plateau is visible between the short strikes. Any close inside that range will lock in the full $3,115.

⏱️ Execution Guidance

-

Hold the position through midday if SPX remains in the 6260–6270 zone

-

Consider closing by 2pm ET for 70% of max profit

-

Set alerts if SPX drops below 6250 or rises above 6275 to manage breakout risk

-

Avoid holding into the final 60 minutes

- Do not be greedy and has no fear of Gamma risk

| 6270 |

📘 Final Takeaway: SPX Iron Condor

This trade played out by the book:

-

✅ Low IV at entry

-

✅ Centered delta structure

-

✅ Solid open interest pin zone

-

✅ No surprise catalysts

-

✅ Theta-driven decay

As long as SPX closes between 6260 and 6270 today, full max profit of $3,115 is yours.

This confirms the power of high-conviction Iron Condors under 2DTE, when structured with proper hedge fund-style filters.

📅 Trade Date: July 9, 2025

📆 Expiry: July 11, 2025

📍 Posted by: VIXTradingHub – Precision Options Flow & Strategy

Here’s a step-by-step guide to safely and efficiently close your 4-leg SPX Iron Condor (expiring today, July 11, 2025):

✅ Goal: Close the Iron Condor to realize profit and eliminate expiration risk

🛡️ You want to avoid assignment risk and any last-hour market spike or crash.

🧰 Step-by-Step: Closing the Iron Condor

🧾 Step 1: Confirm Your Current Position

Log into your broker platform and verify you have:

| Leg | Action | Symbol | Strike |

|---|---|---|---|

| Short Put | –1 | SPXW 11JUL25 P | 6260 |

| Long Put | +1 | SPXW 11JUL25 P | 6190 |

| Short Call | –1 | SPXW 11JUL25 C | 6270 |

| Long Call | +1 | SPXW 11JUL25 C | 6340 |

📐 Step 2: Select “Close Position” or “Create Opposite Order”

In your trading platform:

-

Go to your Options tab or Positions tab

-

Click on your Iron Condor position (or select each leg manually)

-

Choose “Close” or “Create opposite order”

This means:

-

Buy to Close the short put (6260)

-

Sell to Close the long put (6190)

-

Buy to Close the short call (6270)

-

Sell to Close the long call (6340)

✅ You are unwinding all 4 legs at once in a single multi-leg order.

📊 Step 3: Use a Net Debit Order

You sold to open the Iron Condor for $31.15 credit, so you will:

-

Buy to close the entire spread for a debit (hopefully much lower than $31.15)

-

Target a net debit close of $1.00 or less for 90–97% profit lock-in

💡 If SPX stays between 6260–6270, the spread should be trading for just pennies near EOD.

🛠️ Step 4: Set Order Type = “LIMIT”

-

Use Limit Order, not Market Order

-

Suggested limit price = $0.50 – $1.00 for 90%+ profit

-

Do NOT use “Market” unless spreads are ultra-tight and you’re minutes from expiration

🕐 Step 5: Time Your Exit

Ideal close timing:

-

Between 2:00 – 3:30 PM ET

-

Ensure SPX is still between 6260 – 6270

✅ Most time decay will be realized, and liquidity remains strong before the final 30 mins.

🧪 Step 6: Verify Execution & P/L

Once filled:

-

Check that all 4 legs have closed out

-

Confirm realized P/L: should be very close to +$3,000+ if debit close is under $1.00

📌 Step 7: Log the Trade

Record:

-

Entry date: July 9

-

Exit date: July 11

-

Net Credit: $31.15

-

Close Debit: (e.g. $0.80)

-

Net Profit: $30.35 per contract = $3,035 per spread

Optional: save a screenshot of the chart and trade history for journal or case study.

⚠️ Backup Plan (if SPX nears short strikes)

-

If SPX crosses 6260 or 6270:

-

Close early to avoid ITM assignment (even though SPX is cash-settled, avoid unnecessary exposure)

-

Or adjust by rolling the breached side (advanced)

-

Here’s a clear and professional step-by-step guide on how to roll down the put vertical (and optionally the call vertical) on your SPX Iron Condor if the put side is being attacked — while preserving a delta-neutral bias.

🔁 Rolling Adjustments for SPX Iron Condor (Same Expiry or Later)

🎯 Goal:

-

Reduce directional delta if market drops below short put (6260)

-

Adjust the Iron Condor to remain delta-neutral

-

Avoid max loss by repositioning the wings

🛠️ Scenario: SPX Drops Below 6260

Your short put (6260) is now ITM or close, increasing risk.

✅ STEP-BY-STEP: ROLL DOWN PUT VERTICAL

🔧 Step 1: Close the Existing Put Vertical

You’re currently holding:

-

Short Put: 6260

-

Long Put: 6190

🔁 You will:

-

Buy to Close 1x SPXW P 6260

-

Sell to Close 1x SPXW P 6190

📦 Done as a vertical debit order (it will cost money to close if ITM)

🎯 This removes the breached side.

➕ Step 2: Open a New Lower Put Vertical

Pick a lower range, e.g.:

-

Sell to Open 1x SPXW P 6240

-

Buy to Open 1x SPXW P 6170

🛠️ Criteria:

-

Choose strikes 20–30 pts lower to re-center the spread

-

Maintain same width (e.g., 70 pts) to control max loss

-

Check deltas: aim for new short put delta ~0.30–0.45

✅ Enter as a new credit vertical, ideally receiving premium to offset your earlier debit close.

⚖️ Step 3 (Optional): Roll Down the Call Vertical Too (for Delta-Neutral Balance)

If SPX drops and your position becomes bearishly unbalanced, you can:

Roll Down:

-

Buy to Close 6270 Call

-

Sell to Close 6340 Call

-

Sell to Open 6240 Call

-

Buy to Open 6310 Call

✅ Now you’ve rolled both wings down, keeping them equidistant around current SPX

✅ Helps re-center the Iron Condor for delta-neutrality

⏳ Step 4: Match Expiry

-

You may stay with same expiry (if enough time premium exists)

-

Or consider rolling to a later expiry (e.g., Monday July 15) for more time and better credit

📊 Step 5: Verify New Risk Profile

After rolling:

-

Confirm max profit, max loss, new breakeven zone

-

Evaluate whether to scale out or hold full position

-

Monitor new deltas on both legs

🧠 Example Summary:

| Action | Legs | Result |

|---|---|---|

| Close Put Spread | 6260/6190 | Removes threatened wing |

| Open New Put Spread | 6240/6170 | Adds safer lower wing |

| (Optional) Roll Call Spread | 6270/6340 → 6240/6310 | Re-centers delta |

| Match Expiry | 07/11 or extend to 07/15 | Choose based on premium |

🧾 Execution Tip:

-

Use “multi-leg order” or “spread trader” tool on your broker

-

Trade all legs in one order ticket when possible to control slippage

📘 Recap: Rolling Down for Defense + Delta Neutral

| Goal | Action |

|---|---|

| Defend downside breach | Roll down put spread |

| Reduce bearish delta | Roll down call spread too |

| Maintain Iron Condor shape | Keep same wing width |

| Extend theta decay | Optional: roll out in time |

If You would like to learn how to master the Iron Condor strategy then visit Lesson 13 of our Stock Options Education Series

No financial data available for SPX.

No opinion articles found for SPX.

No financial data available for SPX.

No opinion articles found for SPX.

📊 Technical Analysis Overview

Auto-loaded insights for today’s featured stock

Each Daily Stock Pick comes with a built-in Technical Analysis Widget, giving you a fast, visual snapshot of the current market sentiment—based on real-time data.

🔎 What You’ll See:

Overall Signal:

A summary at the top:

✅ Strong Buy, 📈 Buy, ⚖️ Neutral, 📉 Sell, or ❌ Strong SellTimeframes:

Switch between views (1min, 15min, 1hr, Daily, Weekly) to match your trading style—short-term or long-term.Breakdown of Indicators:

Moving Averages – trend-following tools

Oscillators – momentum indicators like RSI & MACD

Pivots – support and resistance levels

💡 How to Use It:

This widget helps confirm or challenge your trading bias. Use it together with:

Our price targets

Options flow & volatility analysis

Institutional and insider sentiment

Options Chain

Select an expiration date to expand for table with strikes, greeks, and mark.

Join the Early Access List

“Get exclusive updates and launch bonuses.”