Powerful 1 Year Technical Analysis of CNC Chart with RSI, MACD & Candlesticks

Chart

Financials

💰 5-Year Financial Overview for CNC

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Revenue | 163,071,000,000 | 153,999,000,000 | 144,547,000,000 | 125,982,000,000 | 111,115,000,000 |

| Cost of Revenue | 146,242,000,000 | 136,684,000,000 | 127,891,000,000 | 111,783,000,000 | 95,899,000,000 |

| Gross Profit | 16,829,000,000 | 17,315,000,000 | 16,656,000,000 | 14,199,000,000 | 15,216,000,000 |

| Operating Expense | 13,654,000,000 | 14,385,000,000 | 15,338,000,000 | 12,415,000,000 | 12,134,000,000 |

| Operating Income | 3,175,000,000 | 2,930,000,000 | 1,318,000,000 | 1,784,000,000 | 3,082,000,000 |

| Net Income | 3,305,000,000 | 2,702,000,000 | 1,202,000,000 | 1,347,000,000 | 1,808,000,000 |

| EPS (Diluted) | 6 | 5 | 2 | 2 | 3 |

| EBITDA | 6,200,000,000 | 5,616,000,000 | 4,058,000,000 | 3,813,000,000 | 4,760,000,000 |

| EBIT | - | - | - | - | - |

| Tax Provision | 963,000,000 | 899,000,000 | 760,000,000 | 477,000,000 | 979,000,000 |

| Interest Income | 0 | 0 | 0 | 0 | 0 |

| Interest Expense | 702,000,000 | 725,000,000 | 665,000,000 | 665,000,000 | 728,000,000 |

| Total Expenses | - | - | - | - | - |

| Basic Shares Outstanding | 521,790,000 | 543,319,000 | 575,191,000 | 582,832,000 | 570,722,000 |

| Diluted Shares Outstanding | 523,744,000 | 545,704,000 | 582,040,000 | 590,516,000 | 579,135,000 |

News & Opinions

🧠 Analysis & Opinions on CNC

- Oscar Health’s Selloff May Be Final Wave in Bullish Elliott Cycle

investing.com • Jul 25, 2025 - Centene Stock Up 5% After First Loss In 13 Years, Bullish Guidance

forbes.com • Jul 25, 2025 - 31 Top Companies Hiring Remotely In 2025

forbes.com • Jul 25, 2025

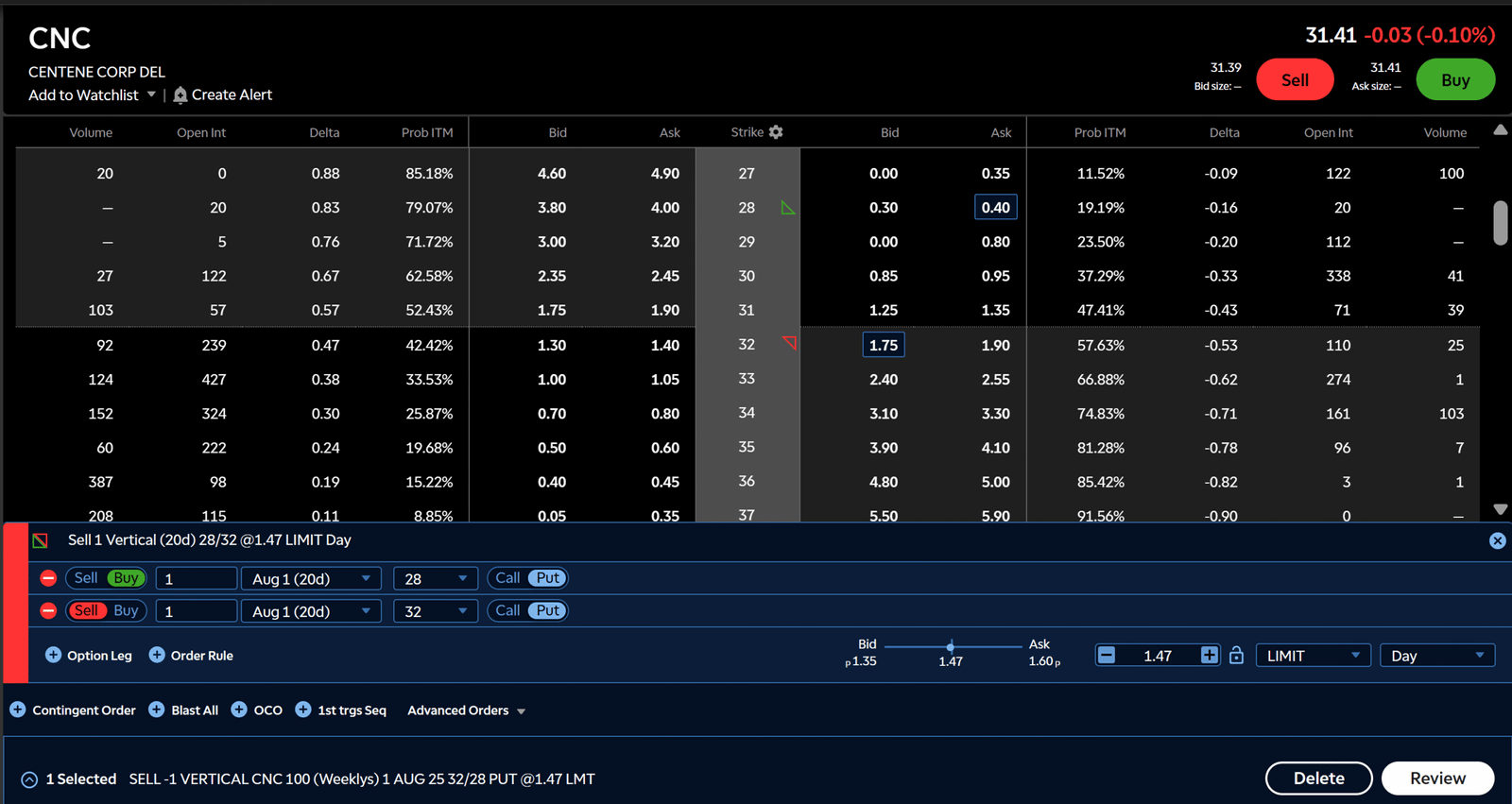

Options Chain

Technical Ratings

📊 Technical Analysis Overview

Auto-loaded insights for today’s featured stock

Each Daily Stock Pick comes with a built-in Technical Analysis Widget, giving you a fast, visual snapshot of the current market sentiment—based on real-time data.

🔎 What You’ll See:

Overall Signal:

A summary at the top:

✅ Strong Buy, 📈 Buy, ⚖️ Neutral, 📉 Sell, or ❌ Strong SellTimeframes:

Switch between views (1min, 15min, 1hr, Daily, Weekly) to match your trading style—short-term or long-term.Breakdown of Indicators:

Moving Averages – trend-following tools

Oscillators – momentum indicators like RSI & MACD

Pivots – support and resistance levels

💡 How to Use It:

This widget helps confirm or challenge your trading bias. Use it together with:

Our price targets

Options flow & volatility analysis

Institutional and insider sentiment

📝 VIXTradingHub Analysis

💰 5-Year Financial Overview for CNC

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Revenue | 163,071,000,000 | 153,999,000,000 | 144,547,000,000 | 125,982,000,000 | 111,115,000,000 |

| Cost of Revenue | 146,242,000,000 | 136,684,000,000 | 127,891,000,000 | 111,783,000,000 | 95,899,000,000 |

| Gross Profit | 16,829,000,000 | 17,315,000,000 | 16,656,000,000 | 14,199,000,000 | 15,216,000,000 |

| Operating Expense | 13,654,000,000 | 14,385,000,000 | 15,338,000,000 | 12,415,000,000 | 12,134,000,000 |

| Operating Income | 3,175,000,000 | 2,930,000,000 | 1,318,000,000 | 1,784,000,000 | 3,082,000,000 |

| Net Income | 3,305,000,000 | 2,702,000,000 | 1,202,000,000 | 1,347,000,000 | 1,808,000,000 |

| EPS (Diluted) | 6 | 5 | 2 | 2 | 3 |

| EBITDA | 6,200,000,000 | 5,616,000,000 | 4,058,000,000 | 3,813,000,000 | 4,760,000,000 |

| EBIT | - | - | - | - | - |

| Tax Provision | 963,000,000 | 899,000,000 | 760,000,000 | 477,000,000 | 979,000,000 |

| Interest Income | 0 | 0 | 0 | 0 | 0 |

| Interest Expense | 702,000,000 | 725,000,000 | 665,000,000 | 665,000,000 | 728,000,000 |

| Total Expenses | - | - | - | - | - |

| Basic Shares Outstanding | 521,790,000 | 543,319,000 | 575,191,000 | 582,832,000 | 570,722,000 |

| Diluted Shares Outstanding | 523,744,000 | 545,704,000 | 582,040,000 | 590,516,000 | 579,135,000 |

🧠 Analysis & Opinions on CNC

- Oscar Health’s Selloff May Be Final Wave in Bullish Elliott Cycle

investing.com • Jul 25, 2025 - Centene Stock Up 5% After First Loss In 13 Years, Bullish Guidance

forbes.com • Jul 25, 2025 - 31 Top Companies Hiring Remotely In 2025

forbes.com • Jul 25, 2025

💰 5-Year Financial Overview for CNC

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Revenue | 163,071,000,000 | 153,999,000,000 | 144,547,000,000 | 125,982,000,000 | 111,115,000,000 |

| Cost of Revenue | 146,242,000,000 | 136,684,000,000 | 127,891,000,000 | 111,783,000,000 | 95,899,000,000 |

| Gross Profit | 16,829,000,000 | 17,315,000,000 | 16,656,000,000 | 14,199,000,000 | 15,216,000,000 |

| Operating Expense | 13,654,000,000 | 14,385,000,000 | 15,338,000,000 | 12,415,000,000 | 12,134,000,000 |

| Operating Income | 3,175,000,000 | 2,930,000,000 | 1,318,000,000 | 1,784,000,000 | 3,082,000,000 |

| Net Income | 3,305,000,000 | 2,702,000,000 | 1,202,000,000 | 1,347,000,000 | 1,808,000,000 |

| EPS (Diluted) | 6 | 5 | 2 | 2 | 3 |

| EBITDA | 6,200,000,000 | 5,616,000,000 | 4,058,000,000 | 3,813,000,000 | 4,760,000,000 |

| EBIT | - | - | - | - | - |

| Tax Provision | 963,000,000 | 899,000,000 | 760,000,000 | 477,000,000 | 979,000,000 |

| Interest Income | 0 | 0 | 0 | 0 | 0 |

| Interest Expense | 702,000,000 | 725,000,000 | 665,000,000 | 665,000,000 | 728,000,000 |

| Total Expenses | - | - | - | - | - |

| Basic Shares Outstanding | 521,790,000 | 543,319,000 | 575,191,000 | 582,832,000 | 570,722,000 |

| Diluted Shares Outstanding | 523,744,000 | 545,704,000 | 582,040,000 | 590,516,000 | 579,135,000 |

🧠 Analysis & Opinions on CNC

- Oscar Health’s Selloff May Be Final Wave in Bullish Elliott Cycle

investing.com • Jul 25, 2025 - Centene Stock Up 5% After First Loss In 13 Years, Bullish Guidance

forbes.com • Jul 25, 2025 - 31 Top Companies Hiring Remotely In 2025

forbes.com • Jul 25, 2025

📊 Technical Analysis Overview

Auto-loaded insights for today’s featured stock

Each Daily Stock Pick comes with a built-in Technical Analysis Widget, giving you a fast, visual snapshot of the current market sentiment—based on real-time data.

🔎 What You’ll See:

Overall Signal:

A summary at the top:

✅ Strong Buy, 📈 Buy, ⚖️ Neutral, 📉 Sell, or ❌ Strong SellTimeframes:

Switch between views (1min, 15min, 1hr, Daily, Weekly) to match your trading style—short-term or long-term.Breakdown of Indicators:

Moving Averages – trend-following tools

Oscillators – momentum indicators like RSI & MACD

Pivots – support and resistance levels

💡 How to Use It:

This widget helps confirm or challenge your trading bias. Use it together with:

Our price targets

Options flow & volatility analysis

Institutional and insider sentiment

Options Chain

Select an expiration date to expand for table with strikes, greeks, and mark.

Join the Early Access List

“Get exclusive updates and launch bonuses.”