🎓 Lesson 16: SPX Short Iron Condor – Premium Farming with High Probability Setup

📌 Overview

The Short Iron Condor is a neutral, income-generating strategy that profits if the underlying stays within a defined range until expiration. When applied to SPX (S&P 500 Index Options), it becomes a cash-settled, tax-advantaged instrument ideal for advanced traders managing risk with high probability of profit (POP) and defined max loss.

This strategy is widely used by hedge funds, volatility traders, and income-focused portfolios, especially in elevated implied volatility (IV) environments.

🧩 Structure of an SPX Iron Condor (Credit)

A Short Iron Condor consists of four legs, all same expiration:

- Sell 1 OTM Call (short upper strike)

- Buy 1 further OTM Call (long upper strike)

- Sell 1 OTM Put (short lower strike)

- Buy 1 further OTM Put (long lower strike)

📌 You collect a credit upfront, and your profit is maximized if SPX closes between the two short strikes.

💡 Why SPX?

- Cash-settled → No assignment risk, settled in dollars

- No shares involved → Ideal for large account sizes

- CBOE tax rules → 60/40 split (60% long-term, 40% short-term gain) regardless of holding period

- Liquidity & tight bid/ask spreads

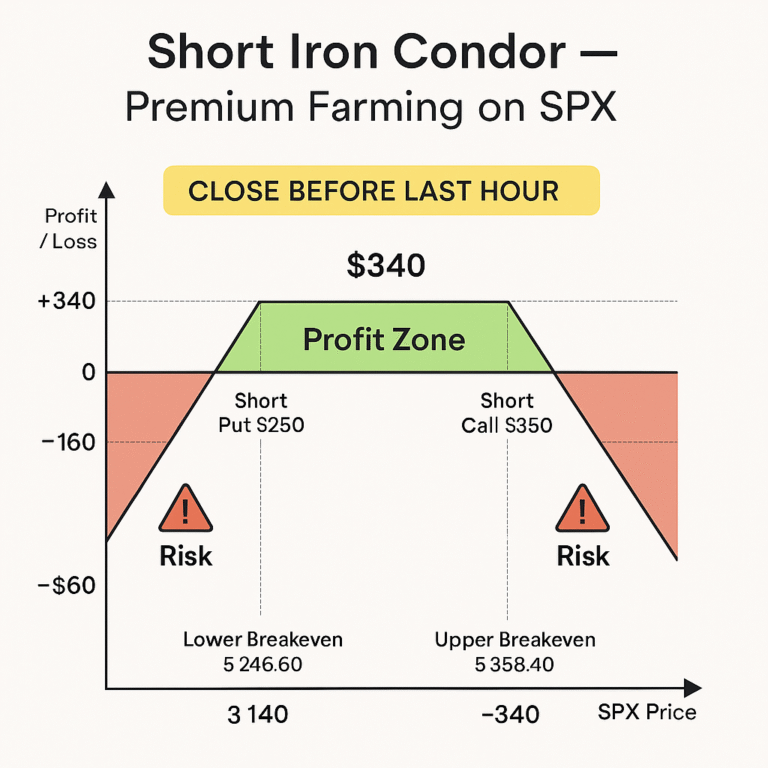

📊 Example: SPX Short Iron Condor (0 DTE or 1 DTE)

- Underlying: SPX @ 5300

- Expiration: Tomorrow (1 DTE trade)

- Short Put: Sell 5250

- Long Put: Buy 5200

- Short Call: Sell 5350

- Long Call: Buy 5400

- Credit Collected: $3.40 = $340

- Max Risk: $5.00 spread – $3.40 credit = $1.60 = $160

- Max Reward: $340

- Probability of Profit: ~80% if short legs are set at Δ 0.10–0.15

- Breakeven Range: 5250 – 3.40 and 5350 + 3.40 → ~5246.60 to ~5353.40

🔁 Trade Plan Framework

| Phase | Action |

|---|---|

| Pre-open | Identify SPX range using VWAP + overnight high/low |

| 9:30–10:00 AM | Enter trade once implied move stabilizes |

| Midday | Adjust or hedge only if SPX tests short strikes |

| EOD | Close if premium decays to 10–20% of original credit, or hold into cash settlement cautiously |

⚠️ Gamma Risk on Expiration Day (0 DTE)

- Gamma explodes during the last 2 hours of expiration day, leading to sudden P/L swings.

- Recommended: Close 1 hour before market close, especially if SPX is near either short strike.

- Avoid holding to last-minute settlement unless strategy is delta-neutral or has a wide buffer.

Learn more about the correlation between SPX and Gamma at Barchart.com

🧠 Tips for Successful SPX Iron Condor Execution

| Tip # | Wisdom |

|---|---|

| 1 | Use high IV Rank days for better premium collection |

| 2 | Set short legs at ~1 SD (Δ 0.10–0.15) for high POP |

| 3 | Collect at least 1/3 of width as premium (e.g., $1.66 on a $5 spread) |

| 4 | Exit early with 50–70% of max profit or if SPX moves near short strikes |

| 5 | Watch economic calendars: Avoid major Fed, CPI, Jobs Report days unless you’re directional |

| 6 | Consider weekly expiration (Wednesdays and Fridays) with 1–2 DTE for best time decay + manageable Gamma |

📉 Greeks at Work

| Greek | Impact |

|---|---|

| Theta | Strong positive – time decay works for you |

| Delta | Near zero (neutral); increases rapidly near short strikes |

| Gamma | Extremely high near expiry – manage tightly |

| Vega | You benefit from falling IV after entry |

✅ Key Takeaways

“The SPX Short Iron Condor is a favorite of professionals for a reason: when volatility is overpriced, time is your best friend. But don’t sleep on Gamma — in the final hour, it will bite.”

Check out our Stock Options Analysis & Trading Strategies for more content like this!