🎓 Lesson 15: Ratio Spreads & Backspreads – Tail-Risk Strategies for Volatility Breakouts

📌 Overview

Ratio spreads and backspreads are advanced multi-leg options strategies that involve uneven quantities of contracts, typically selling one option and buying two or more. These strategies are useful when you want low-cost exposure to big directional moves or to hedge against sharp volatility spikes with limited capital.

They allow you to skew your payoff: either reduced cost with capped risk (ratio spread) or defined risk with unlimited upside (backspread).

🧩 Part 1: Ratio Spread

A Ratio Spread involves selling one option and buying more than one of the same type and expiration — often with different strikes.

✅ Example: 1×2 Call Ratio Spread

- Sell 1 OTM Call (e.g., $120)

- Buy 2 higher OTM Calls (e.g., $125)

🧠 Goal: Profit if the stock rises slowly toward the higher strikes — but not too fast.

⚠️ Warning: If the stock blows past the long strikes, you can face unlimited loss.

🧩 Part 2: Backspread (Reverse Ratio)

A Backspread reverses the ratio: buy more options than you sell.

Used when you expect large moves in one direction and want to profit from explosive volatility.

✅ Example: Put Backspread (1×2)

- Sell 1 ATM Put (e.g., $100)

- Buy 2 lower-strike Puts (e.g., $90)

🧠 Goal: Profit if the stock crashes below both strikes.

- Defined risk near breakeven

- Unlimited gain as price collapses

- Can be structured for net credit (ideal) or small debit

📊 Ratio vs Backspread Comparison

| Feature | Ratio Spread (1×2) | Backspread (2×1) |

|---|---|---|

| Directional Bias | Moderate move preferred | Large move expected |

| Capital Efficiency | High | Moderate |

| Max Profit | Limited | Unlimited (with proper setup) |

| Max Loss | Unlimited (if unhedged) | Defined (if net credit setup) |

| Ideal IV Environment | Low → Rising | High → Exploding |

| Use Case | Theta/Delta combo play | Event-driven hedge or lottery |

🧪 Real-World Application

Ticker: IWM (Russell 2000 ETF)

Price: $195

Outlook: High volatility event expected (CPI report)

Strategy: Put Backspread for crash hedge

| Leg | Strike | Action | Premium |

|---|---|---|---|

| Sell 1 Put | $190 | Sell | $5.40 |

| Buy 2 Puts | $180 | Buy | $2.30 x 2 = $4.60 |

| Net Credit | $0.80 |

- Max loss: Between $190–$180 (capped at $9.20 per contract)

- Max gain: Unlimited if IWM drops well below $180

- Breakeven 1: $190 (top of range)

- Breakeven 2: ~$170.80 (profit zone opens below this)

🧠 Strategic Use Cases

| Scenario | Strategy | Reason |

|---|---|---|

| Expecting mild upward drift | Call Ratio Spread | Reduce cost of bullish play |

| Expecting market crash | Put Backspread | Tail-risk hedge with unlimited gain |

| Post-earnings volatility crush | Backspread | Exploit Vega and Gamma spikes |

| SPX/QQQ breakout after consolidation | Call Backspread | Low-cost breakout bet |

⚠️ Risk Management Tips

- Ratio Spreads can become Gamma bombs if underlying breaks through far OTM legs.

- Always monitor Delta and Gamma daily on short legs.

- Prefer setting up Backspreads for net credit — that way you profit even if the move doesn’t come.

- Roll or hedge ratio spreads if the underlying moves too fast.

Learn more about risk management at Investopedia

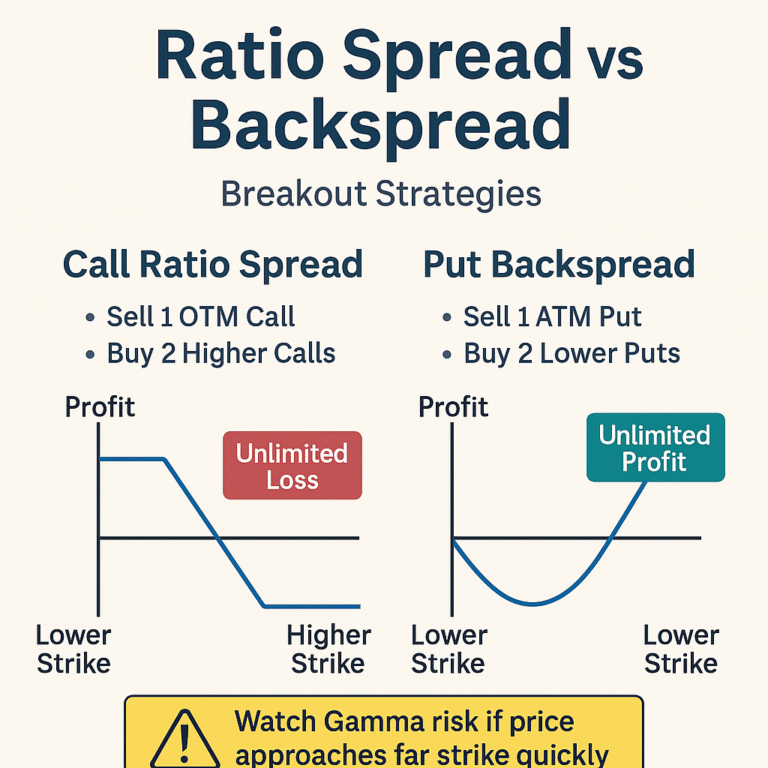

🖼️ Infographic Suggestion

Title: “Ratio Spread vs Backspread – Breakout Strategies”

Include:

- Side-by-side P/L chart

- Highlight danger zone of Ratio Spread

- Highlight unlimited gain zone of Backspread

- Gamma risk warning overlay

🧠 Pro Trader Wisdom

“Ratio spreads give you premium with a catch. Backspreads give you unlimited payout — only if the market screams. Use them sparingly, hedge them wisely, and never sleep on Gamma exposure.”

Feel free to check out our Stock Options Analysis & Trading Strategies for a deeper understanding & real world applicability!