🎓 Lesson 14: Diagonal Spreads – Time-Based Edge with Directional Power

📌 Overview

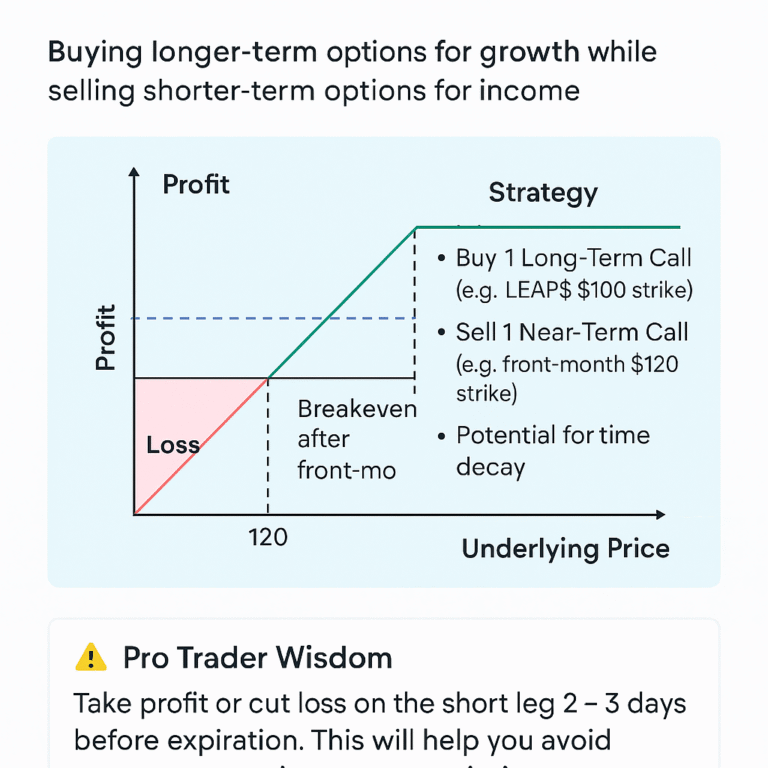

A Diagonal Spread is a hybrid options strategy that combines the benefits of a Calendar Spread and a Vertical Spread. It uses options of the same type (calls or puts) but with different expirations and different strikes. Traders use this strategy to benefit from time decay (Theta) on the short leg while holding a longer-dated option for directional gains and volatility exposure.

This is especially effective when you want to simulate a covered call with low capital or position long-term (e.g., LEAPS) while selling short-term premium for income.

🧩 Structure of a Diagonal Spread

✅ Call Diagonal Spread

- Buy 1 long-dated ITM Call (e.g., 90+ DTE or LEAPS)

- Sell 1 short-dated OTM Call (e.g., 7–30 DTE)

Goal: Profit from stock rising slowly, benefiting from Theta decay on the short call and Delta gain on the long call.

✅ Put Diagonal Spread

- Buy 1 long-dated ITM Put

- Sell 1 short-dated OTM Put

Goal: Profit from a slow drift downward or from volatility expansion in bear markets.

📊 Comparison: Calendar vs Diagonal vs Vertical

| Feature | Calendar | Diagonal | Vertical |

|---|---|---|---|

| Same Strike | ✅ Yes | ❌ No | ❌ No |

| Same Expiry | ❌ No | ❌ No | ✅ Yes |

| Directional Bias | Neutral | Yes | Yes |

| Time Decay Advantage | ✅ Short leg | ✅ Short leg | ❌ No (neutral) |

| Complexity | Moderate | Moderate | Basic |

🧪 Example: Bullish Call Diagonal on NVDA

- NVDA Price: $120

- Buy Jan 2026 $100 Call @ $30.50 (Δ 0.80, long-dated LEAPS)

- Sell July 19 $125 Call @ $2.40 (Δ 0.30, 21 DTE)

🔧 Net Debit: $30.50 – $2.40 = $28.10

- Theta Positive: short call decays faster

- Upside capped temporarily at $125 for the short term

- Adjust monthly: roll short call forward/out if NVDA rises too fast

- If NVDA stays between $120–$125, you profit from both time decay and Delta appreciation

💡 Strategic Use Cases

| Scenario | Strategy | Why |

|---|---|---|

| Slow bull market | Bull Call Diagonal | Generate income while staying long |

| Post-earnings drift | Diagonal | IV contraction + Theta benefit |

| Synthetic covered call | LEAPS + short calls | Lower capital version of covered call |

| Hedging | Bearish put diagonal | Slower decline hedge with income |

| Volatility skew | Long Vega on back leg | Use when long leg is undervalued in IV terms |

⚠️ Risk Management & Rolling Tips

- Gamma Risk: Close or roll the short leg 2–3 days before expiration to avoid violent Delta swings.

- If the stock rallies past the short strike, roll up and out to a later expiry.

- If it collapses, let short expire worthless and consider repositioning.

Read more on risk management at Investopedia

🔁 Rolling Logic Table

| Price Action | Rolling Action |

|---|---|

| Stock nears short strike | Roll up/out to higher strike |

| Stock stagnant | Roll same strike forward 1–2 weeks |

| Stock drops far below | Let expire; re-evaluate short leg later |

📉 Greeks Insight

| Greek | Impact |

|---|---|

| Theta | Short leg decays faster = net positive Theta |

| Delta | Long leg benefits from directional movement |

| Vega | Long leg sensitive to IV increase (more exposure) |

| Gamma | Manage risk near expiry; can swing quickly |

⚠️ Pro Trader Warning

Do not wait until the last day to close or roll your short leg. Gamma risk increases exponentially in the final trading hours, which can result in sudden and unrecoverable losses.

✅ Key Takeaways

“Diagonal spreads are your ticket to combining long-term vision with short-term income. When used with high-conviction stock picks and proper timing, they offer one of the best risk/reward setups in the options playbook.”

Check out real life examples of options strategies being applied in our Stock Options Analysis & Trading Strategies!