🎓 Lesson 13: Iron Condor & Iron Butterfly – Profiting from Rangebound Markets with Defined Risk

📌 Overview

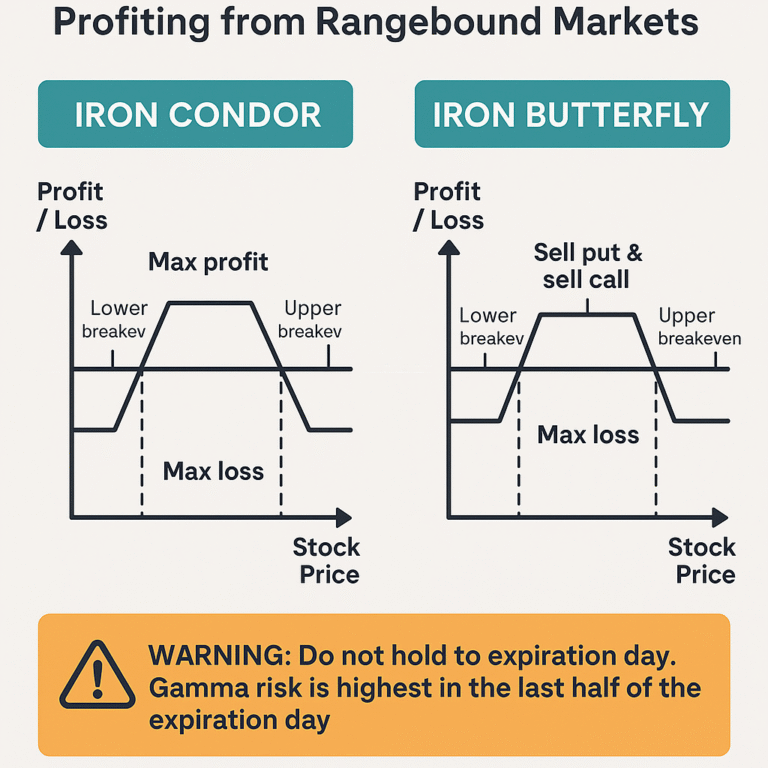

When you expect a stock or ETF to stay within a range, rather than move sharply in either direction, neutral strategies like Iron Condors and Iron Butterflies offer defined risk with high probability of profit. These setups are especially effective in high Implied Volatility (IV) environments where options premiums are inflated — allowing traders to sell time and volatility.

🧩 Part 1: What Is an Iron Condor?

An Iron Condor is a 4-leg neutral credit spread made up of:

- 1 Bull Put Spread (sell put + buy lower put)

- 1 Bear Call Spread (sell call + buy higher call)

All legs have the same expiration date.

✅ Ideal Setup

- You believe the stock will stay between two strike prices.

- High IV makes it lucrative — you’re selling rich premium.

- Used before earnings or when rangebound technicals are confirmed.

🔧 Example: Iron Condor on SPY @ $520

| Leg | Strike | Action | Premium |

|---|---|---|---|

| Buy Put | $500 | Buy | -$0.50 |

| Sell Put | $510 | Sell | +$1.50 |

| Sell Call | $530 | Sell | +$1.60 |

| Buy Call | $540 | Buy | -$0.60 |

| Total Net Credit | $2.00 |

- Max Profit: $200 per contract (credit received) if SPY stays between $510–$530

- Max Loss: $800 per contract

- Break-even range: $508–$532

- Probability of Profit (POP): ~65–75% if short legs are set ~1 SD from spot

Learn more on the SPY ETF at ETF.com

🧩 Part 2: What Is an Iron Butterfly?

An Iron Butterfly compresses the Iron Condor, using ATM short strikes:

- Sell 1 ATM Call & Put

- Buy 1 OTM Call (higher)

- Buy 1 OTM Put (lower)

All with the same expiration

✅ Ideal Setup

- Stock is unlikely to move much (low expected move)

- You want higher premium than Condor, but are okay with tighter risk zone

- Works well with pinning behavior near OPEX (option expiration)

🔧 Example: Iron Butterfly on AAPL @ $200

| Leg | Strike | Action | Premium |

|---|---|---|---|

| Buy Put | $190 | Buy | -$0.80 |

| Sell Put | $200 | Sell | +$2.80 |

| Sell Call | $200 | Sell | +$2.80 |

| Buy Call | $210 | Buy | -$1.00 |

| Total Net Credit: | $3.80 |

- Max Profit: $380 if AAPL pins at $200 on expiry

- Max Loss: $620 (difference between strikes – credit)

- Breakeven range: $196.20–$203.80

- POP: ~50–55%, but with higher reward if pinned near ATM

📊 Comparison: Iron Condor vs Iron Butterfly

| Feature | Iron Condor | Iron Butterfly |

|---|---|---|

| Premium Collected | Lower | Higher |

| Risk Range | Wider | Narrower |

| POP | Higher (~65–75%) | Lower (~50–55%) |

| Breakeven Width | Wider | Tighter |

| Market Outlook | Rangebound (low-move) | Pinning behavior (very low move) |

| Best IV Setup | High IV, no catalyst | High IV, very flat chart or OPEX pin setup |

🧠 Part 3: Strategic Considerations

🔎 When to Use Iron Condor

- Elevated IV with expected rangebound earnings (e.g., post-earnings hangover)

- Stocks like SPY, QQQ, IWM tend to stay within expected moves 68% of the time

- Use 1 SD or Δ ~0.15–0.20 strikes for short legs

🔎 When to Use Iron Butterfly

- ATM strike has heavy open interest

- No major news expected, chart forming tight consolidation

- Seeking max ROI near expiration or pin days (OPEX, Friday expiry)

🧪 Real Application: Iron Condor on META (July Expiry)

- Price: $470

- Setup:

- Sell $450 Put / Buy $440 Put

- Sell $490 Call / Buy $500 Call

- Credit Received: $3.20

- Max Risk: $6.80

- POP: ~72%

- Trade Thesis: META IV Rank = 71%, no catalyst for 3 weeks, holding between $450–$490

✅ Key Takeaways

“Iron Condors are your steady income machine when the market sleeps. Iron Butterflies are your premium sniper when the market pins. Both reward patience and precision — especially in high IV zones.”

Check out our Stock Options Analysis & Trading Strategies to see the Iron Condor & Iron Butterfly in action!