.

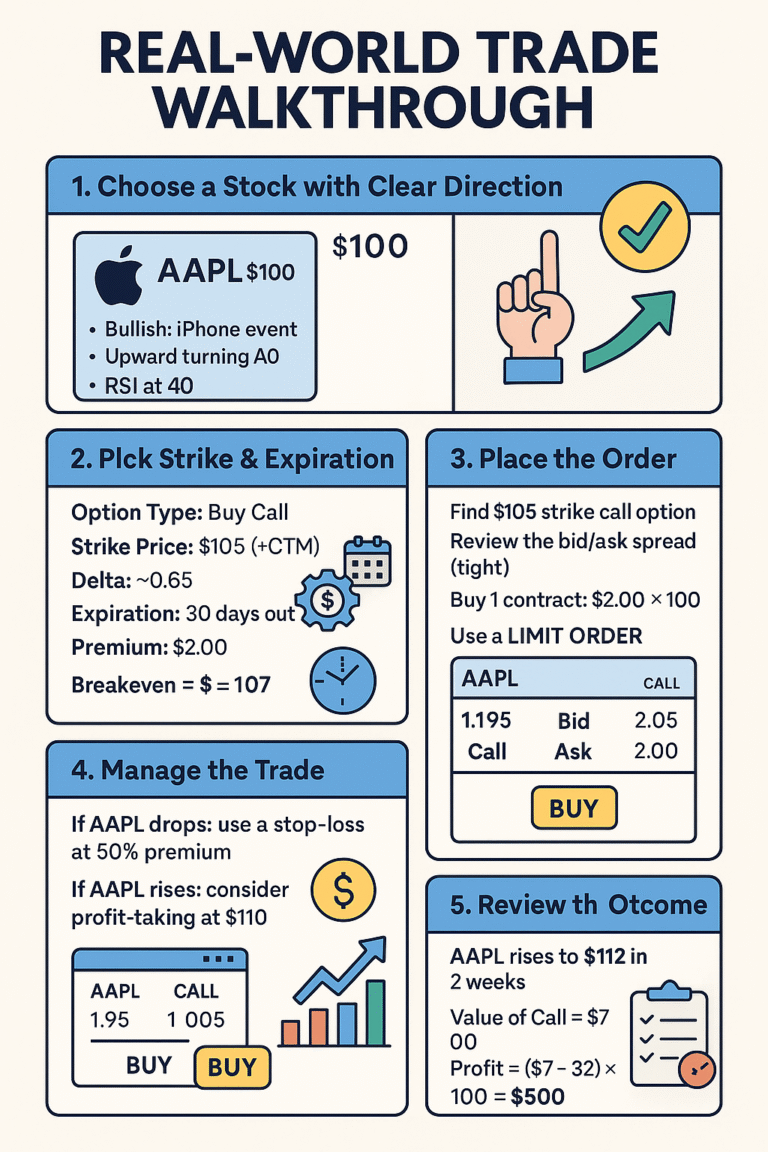

📘 Lesson 10: Real-World Trade Walkthrough — How to Place and Manage Your First Options Trade

🧠 Core Concept

This lesson walks you through an actual step-by-step trade using all the skills you’ve learned—selecting the right stock, picking the right strike and expiration, placing the order, and managing it smartly.

✅ Step 1: Choose a Stock with Clear Direction

Let’s say we’re bullish on Apple Inc. (AAPL)

- Current Price: $100

- Bullish Catalyst: iPhone event next week

- Technicals: MACD turning upward, RSI at 40 (rebounding from oversold)

→ You believe AAPL may hit $110+ in the next 3–4 weeks.

✅ Step 2: Pick Strike & Expiration

Use what you learned in Lesson 9.

📌 Trade Setup:

- Option Type: Buy Call

- Strike Price: $105 (slightly OTM)

- Delta: ~0.65

- Expiration: 30 days out

- Premium: $2.00

🔁 Breakeven:

- $105 (strike) + $2 (premium) = $107

✅ Step 3: Place the Order

Log into your broker platform (e.g., TDAmeritrade, Robinhood, Webull, etc.)

- Search: AAPL

- Go to “Options Chain”

- Select expiration: Next month’s 30-day Friday

- Find $105 strike CALL

- Review the Bid/Ask spread (should be tight, e.g., $1.95 / $2.05)

- Click Buy to Open

- Use a LIMIT ORDER for $2.00

- Confirm your contract: 1 contract = 100 shares = $200

✅ Step 4: Manage the Trade

📉 If AAPL drops or goes sideways:

- Set a mental or actual stop-loss at 50% of your premium = $100 max loss

- Be aware of time decay (Theta accelerates with 7–10 days left)

📈 If AAPL rises:

- Watch when the stock hits $107+ (break-even)

- Consider taking profits at $110 = Intrinsic value = $5 ($500 value)

- You can sell to close your call to lock in profit

Check out more of Apple(AAPL)

✅ Step 5: Review the Outcome

Win or lose, analyze:

- Did the move happen within the time frame?

- Was the strike appropriate?

- Did Theta or Vega help/hurt you?

Use this to refine your future trades

💡 Sample Outcome

| AAPL Rises to $112 in 2 Weeks |

|---|

| Value of Call ≈ $7.00 |

| Profit = ($7 – $2) × 100 = $500 |

🧠 Bonus: Use a Trade Checklist

Before placing any option trade, ask:

- What’s my thesis?

- What is the event or catalyst?

- What strike has the right delta and reward?

- What’s my max risk?

- What’s my exit plan?

✅ Quick Quiz

- What’s the break-even on a $105 strike call bought for $2?

- Why do you use a limit order instead of market?

- When should you exit a losing trade?

🧠 Answers

- $107

- To avoid slippage from wide spreads

- Around 50% premium loss, or if thesis fails

See more of our real world trading walk throughs in our Stock Options Analysis & Trading Strategies.