📘 Lesson 9: Choosing the Right Strike Price & Expiration — The Key to Smarter Trades

🧠 Core Concept

Your option’s strike price and expiration date determine how much risk, reward, and time you have in a trade.

Picking the right combination is just as important as predicting direction.

🎯 Part 1: Choosing the Right Strike Price

📊 What Is a Strike Price?

It’s the fixed price at which you can buy (call) or sell (put) the underlying stock.

🟢 Calls – Bullish Setup

| Outlook | Strike Selection | Why |

|---|---|---|

| Very Bullish | Slightly OTM (e.g., +5%) | More profit, cheaper premium |

| Moderately Bullish | ATM (At The Money) | Balanced risk/reward |

| Conservative Bullish | ITM (In The Money) | High delta, safer, costlier |

Example:

AAPL is $100

- $95 Call = ITM → safer, more expensive

- $100 Call = ATM → balanced

- $105 Call = OTM → cheaper, more risk

Dive deeper into what ITM, ATM, & OTM are.

🔴 Puts – Bearish Setup

| Outlook | Strike Selection | Why |

|---|---|---|

| Very Bearish | Slightly OTM (e.g., -5%) | Cheaper, higher reward |

| Moderately Bearish | ATM | Balanced |

| Conservative Bearish | ITM | Higher delta, more protection |

📐 Use Delta to Guide You

| Delta Value | What It Means |

|---|---|

| 0.80–1.00 | Deep ITM, expensive, stable |

| 0.60–0.75 | Sweet spot for directional trades |

| 0.30–0.50 | OTM, riskier, lower probability |

Beginners should focus on Delta 0.60–0.75 for balance between risk & reward.

⏳ Part 2: Choosing the Right Expiration Date

🗓️ Time Is a Weapon or a Trap

Options lose value over time (Theta), so time must be chosen carefully.

🔑 General Guidelines:

| Time Frame | Use When… | Notes |

|---|---|---|

| 0–7 Days | High-risk, quick moves | Avoid unless experienced |

| 8–30 Days | Short-term swing or catalyst trade | Watch Theta closely |

| 30–90 Days | Safer for directional trades | Less decay, more flexibility |

| 90+ Days | Long-term bets or LEAPS (investor-style) | Expensive but more stable |

✅ Best for Beginners:

- Start with 30–60 day expiration

- Pick expiration after earnings, not before

- Avoid buying same-week options unless part of a strategy

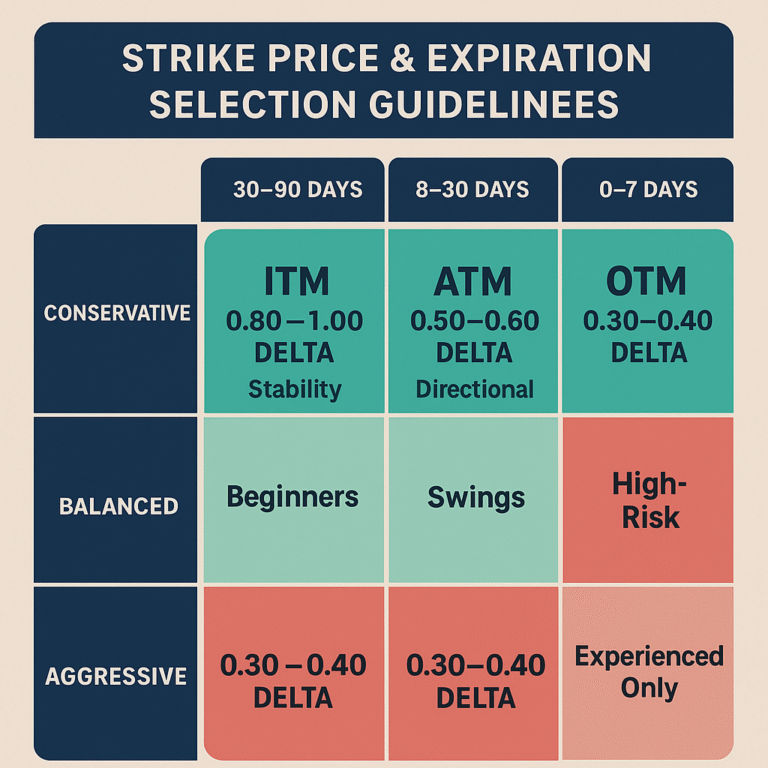

⚖️ Summary: Smart Strike + Time = Better Odds

| Setup Type | Strike | Expiration | Best For |

|---|---|---|---|

| Conservative | ITM (high delta) | 30–90+ days | Beginners, stability |

| Balanced | ATM | 30–60 days | Directional swing trades |

| Aggressive | OTM (low delta) | Short-term (≤14 days) | Experienced traders only |

✅ Quick Quiz

- What delta range is ideal for beginners?

- Should you trade earnings with short-term options?

- Which loses value faster: 7-day or 60-day option?

🧠 Answers

- Pick options with delta between 0.60 and 0.80 — they move more like the stock and are easier to manage.

- No. They lose value fast after earnings, even if you’re right. Too risky for beginners.

- 7-day options lose value faster because they expire soon — time decay hits harder.

Check out various strike prices and expirations in our very own Options Chain.