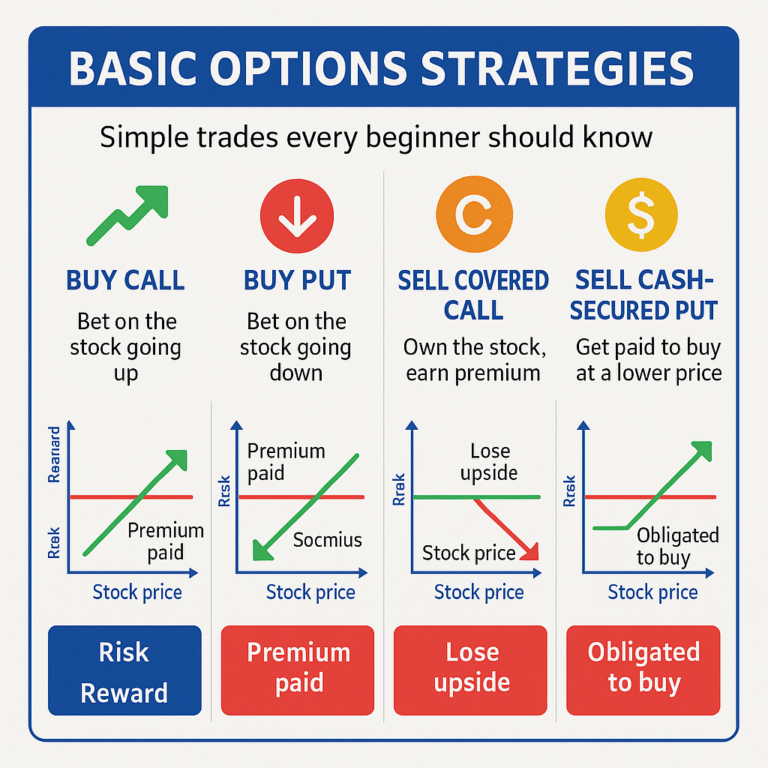

Lesson 7: Basic Options Strategies — Simple Trades Every Beginner Should Know

🧠 Core Concept of Options Strategies

Now that you understand Calls and Puts, it’s time to learn how to actually use them.

This lesson covers the 4 easiest and most beginner-friendly options strategies:

- Buying Calls

- Buying Puts

- Selling Covered Calls

- Selling Cash-Secured Puts

These options strategies form the foundation for more advanced trades later.

1️⃣ Buying a Call Option

Use when you think the stock will go UP

You pay a premium for the right to buy shares at a certain price.

Example:

- AAPL is $100

- You buy a $105 Call, paying $2.00

- If AAPL rises to $115 → You make ($115 − $105 − $2) × 100 = $800

Pros:

- Low cost, high upside

- Defined risk (you only lose the premium)

Cons:

- Time decay eats value (Theta)

- Needs significant move to profit

2️⃣ Buying a Put Option

Use when you think the stock will go DOWN

You pay a premium to lock in a high selling price.

Example:

- SPY is $400

- You buy a $390 Put for $3.00

- If SPY drops to $370 → You make ($390 − $370 − $3) × 100 = $1,700

Pros:

- Profit from falling prices

- Can hedge your stock positions

Cons:

- Premium can expire worthless if no drop

- Theta decay and IV sensitivity

3️⃣ Selling a Covered Call

Use when you own shares and want to earn extra income

You sell a Call against shares you already hold.

Example:

- You own 100 shares of MSFT at $300

- You sell a $310 Call and receive $2.50 (=$250)

Outcomes:

- If MSFT stays below $310 → You keep the shares + $250

- If MSFT rises above $310 → You sell the shares at $310, still with a profit

Pros:

- Generates income passively

- Low risk if you’re holding the stock anyway

Cons:

- You cap your upside (must sell at strike if called)

- Must own 100 shares

4️⃣ Selling a Cash-Secured Put

Use when you want to buy a stock at a lower price

You sell a Put and set aside cash in case you’re assigned.

Example:

- You want to buy NVDA at $600 (current price $630)

- Sell a $600 Put, receive $7.00 (=$700)

Outcomes:

- If NVDA stays above $600 → You keep the $700

- If NVDA drops below $600 → You must buy 100 shares at $600, but your net price is $593

Pros:

- Get paid to wait for a dip

- Enter stock at a discount

Cons:

- Must be ready to buy 100 shares

- Still exposed if stock crashes hard

Go deeper into Managing Cash Secured Puts

🧮 Options Strategies Comparison Table

| Options Strategies | Market Outlook | Max Risk | Max Reward | Requires Stock? |

|---|---|---|---|---|

| Buy Call | Bullish | Premium Paid | Unlimited | ❌ |

| Buy Put | Bearish | Premium Paid | Strike − Premium | ❌ |

| Sell Covered Call | Neutral/Bullish | Losing upside | Premium + Stock Gain | ✅ |

| Sell Cash-Secured Put | Bullish/Neutral | Buy Stock at Strike | Premium Earned | 💵 (cash only) |

✅ Option Strategies Quick Quiz

- Which strategy pays you while you wait to buy stock?

- What’s the max risk when buying a call?

- What do you need to sell a covered call?

🧠 Answers

- Selling a cash-secured put

- The premium paid

- You must own 100 shares of the stock

Check out how we apply these various options strategies in our Stock Options Analysis & Trading Strategies!