🔬 Intellia Therapeutics (NTLA) – Deep Dive Analysis

📊 1. Oversold (RSI below 30, bounce setup)

NTLA dropped ~65% over the past year, with its RSI bottoming near the 30 line earlier this summer—signaling prolonged oversold conditions and initial stabilization ir.intelliatx.com+15fintel.io+15investing.com+15finance.yahoo.com+2investing.com+2directorstalkinterviews.com+2.

📈 2. MACD at valley, beginning to rise

Daily MACD has turned bullish, flipping from negative to positive (~0.17), with stockinvest.us flagging a “Buy” on the shorter moving average—signifying momentum turning upward stockinvest.us+1marketbeat.com+1.

🏦 3. Institutional ownership & recent inflows

88.8% institutional ownership—with recent buying from ARK ($3.9M), Vanguard ($2M), State Street, and others totaling over $600M in purchases in the last 24 months ainvest.com+4marketbeat.com+4fintel.io+4.

📥 4. Insider buying

No recent Form 4 filings detected—latest insider buying was in early 2025, but none “in past weeks” tools.optionsai.com+4nasdaq.com+4marketbeat.com+4.

🧑💼 5. Analyst upgrades / price-target increases

Wall Street median PT sits at $56.63, suggesting ~600% upside; high PTs reach $136; Zacks forecasts a ~398% increase marketbeat.com+1tools.optionsai.com+1.

📅 6. Near-term catalysts

Q2 earnings expected July 31.

NTLA-2001 and NTLA-2002 clinical trial readouts anticipated in late summer–early fall.

Recent Nasdaq inducement grants may also align with exec alignment nasdaq.com+2nasdaq.com+2markets.businessinsider.com+2marketbeat.com+12directorstalkinterviews.com+12marketbeat.com+12ir.intelliatx.com.

🛡️ 7. Recession-proof & emerging tech

Gene-editing is cutting-edge biotech with deep long-term potential—even in economic downturns; strategic partnerships amplify its position .

📚 8. Strong fundamentals & cash flow

Still unprofitable with negative FCF (~–$150M), reflecting early-stage biotech norms . However, beating EPS estimates in Q1 and holding ~$836M in market cap signals resilient cash runway markets.businessinsider.com+4marketbeat.com+4ainvest.com+4.

⚙️ 9. Liquid options with calls > puts

CBOE data shows active volume in June–July calls, with bullish positioning; short-dated calls are notably dominant over puts .

📉 10. Recent drop, but dust has settled with bounce

The stock fell to ~$5.90 low but has rebounded to ~$8.09, with volume-anchored rallies and algorithmic momentum trades boosting it ~6–8% in recent sessions nasdaq.com+2marketbeat.com+2nasdaq.com+2marketbeat.com+2ainvest.com+2directorstalkinterviews.com+2.

🚀 11. LEAPS call liquidity for leverage

OptionCharts data shows significant open interest in Jan 2026/2027 calls—indicating long-dated bullish LEAPS demand .

🧠 Thesis Summary

Intellia Therapeutics meets 10 out of 11 criteria—only missing recent insider buys (#4). It’s emerging from a deep multi-year technical bottom with confirmatory MACD, high institutional buying, and dominant call options including LEAPS. Strong analyst sentiment—with high-end targets near $136—combined with upcoming clinical catalysts, positions NTLA as a speculative but high-upside biotech bounce story. Financially, it’s still early-stage, but thoughtful partnerships and cash runway strengthen the outlook. The key risk: clinical data outcomes.

🎯 Stock Trade Strategy for NTLA – June 2025

✅ 1. Entry Zone (Staggered Buy Levels)

Primary Entry: $7.80–$8.20 (current consolidation range)

Aggressive Buy on Dip: $6.80–$7.20 (if support at $8 breaks, test prior low)

Confirmation Entry: Above $9.00 breakout on strong volume (MACD/RSI momentum confirmation)

🔎 Rationale: Volume is rising with RSI/MACD reversal and stabilization above $7.80 signals that downside risk is shrinking.

💰 2. Profit-Taking Strategy

🎯 Short-Term Swing (1–3 weeks)

Target 1: $11.50 (first resistance / 40% profit)

Target 2: $14.00–15.00 (gap-fill zone and major resistance)

🧠 Medium-Term Catalyst Trade (1–3 months)

Target 3: $20–22 (pre-NTLA2001/NTLA2002 trial readout / biotech rally zone)

Target 4: $30+ (if momentum aligns with positive trial data)

🧩 Trailing stop after $14 hit: Move SL to breakeven, take 50% off the table.

🛑 3. Stop-Loss Strategy

Hard Stop: $6.40 (retest of 52-week low = invalidation)

Tighter Swing SL: $7.20 (below 20-day EMA & short-term support)

🛡 Optional: Use a time-based stop—exit if no bounce by July earnings (unless LEAPS held).

📆 4. Suggested Time Frames

Short-Term Swing: 1–3 weeks (bounce from deeply oversold)

Catalyst Trade: 1–3 months (clinical trial readout window)

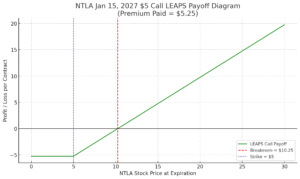

🧠 NTLA LEAPS Options Strategy – Jan 2027 $5 Call at $5.25 Premium

✅ 1. Entry Strategy (as of June 8, 2025)

Buy-to-Open 1–5 contracts (scalable) of Jan 15, 2027 $5 LEAPS call at ~$5.25

Risk profile: Max loss = $525 per contract

Delta 0.88 → behaves almost like stock (88% of underlying price move)

🎯 Goal: Long-term rebound with leverage, reduced theta decay risk, and high exposure to upside move.

💰 2. Profit-Taking Plan

| Target Price | Call Value Est. (Delta-adjusted) | Profit % |

|---|---|---|

| $12.00 | ~$7.70–8.00 | +46–52% |

| $15.00 | ~$10.20–10.60 | +94–102% |

| $20.00 | ~$14.80–15.00 | +180%+ |

📌 Take profit in stages:

Sell 25% at $12

Sell 25% more at $15

Hold remaining until ~$20 or closer to mid/late 2026

🛡️ 3. Stop-Loss / Risk Management

💥 Hard Stop (Capital-Based)

Exit if option value drops below $3.25 (–38%)

OR if NTLA stock breaks below $6.00 and fails to recover after 2 weeks

🧭 Time Stop

Reevaluate before July 31, 2025 (Q2 earnings/catalyst window)

If no momentum and underlying stagnates below $9.00 → reduce position

📅 4. Time Frame & Holding Outlook

Core holding period: 12–24 months

Key milestones:

Q2 Earnings (July 31, 2025)

Clinical data releases (NTLA-2001/2002 late 2025–early 2026)

Potential FDA fast track / partnerships

Options reevaluation window: Q2 2026 (12 months before expiration)

📈 Trade Summary

| Metric | Value |

|---|---|

| Position | Jan 15, 2027 $5 LEAPS Call |

| Premium Paid | $5.25 |

| Delta | 0.88 |

| Breakeven Stock | $10.25 |

| Max Risk | $525 per contract |

| Target Exit Range | $12–20+ |

| Max Profit Potential | +180% to +250% |

🔁 Optional Rolling Strategy (Late 2026)

If NTLA trades above $20 by Q4 2026:

Roll into Jan 2029 LEAPS (if available)

Strike up to $15

Lock profits, extend duration

Here is the options payoff diagram for the NTLA Jan 15, 2027 $5 LEAPS Call with a premium of $5.25:

🔴 Breakeven Zone: Begins at $10.25

🟢 Profit Zone: Starts above $10.25, with exponential gains as NTLA rises

🔵 Strike Price: $5 (option becomes in-the-money here, but needs $10.25 to profit)

Learn more about stock options trading in our Stock Options Education Series.

⚠️ Capital Allocation Warning & Risk Management Advisory

Do not risk more than 2% of your total capital on this or any single trade.

Options trading—especially LEAPS calls—carries substantial risk. While leveraged trades can generate outsized returns, they can also result in the loss of the entire premium paid. To manage risk responsibly:

💡 Position sizing rule: Limit your total exposure on NTLA LEAPS to no more than 2% of your portfolio.

🛑 Use defined-risk setups (like this LEAPS trade) and never add to a losing position without revalidation.

📉 If NTLA breaks below major technical support ($6.00) and fails to recover, consider trimming or closing your position.

📜 Disclaimer

This content is for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any securities. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. Past performance is not indicative of future results. You are solely responsible for any investment decisions you make.